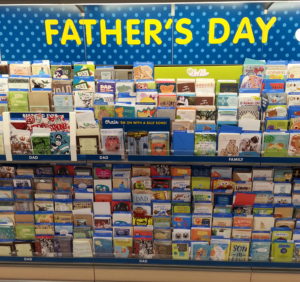

Yet Another Money Lesson From Dad

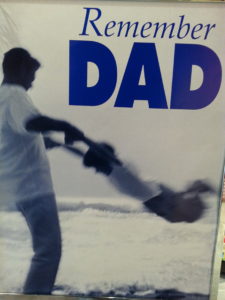

This personal money story for Father’s Day 2022 discusses the subject of taxes and once again is inspired by my father. Here on the Big Words Blog Site, I’ve crafted several stories discussing how Dad’s sage wisdom has impacted my life, whether through a direct lesson, or from my observations of him. Some of his most poignant lessons have involved money and arguably created my love for financial literacy, though he and I don’t see eye to eye on everything money related today. One of Dad’s most important lessons involves an area that is the bane of some people’s existence, while being a pillar to the wealth-building strategy of others, taxes.

We’re All Playing One Big Financial Game

Recently it occurred to me that we’re all playing one big financial game, now a video game in our modern technological age. Certainly, money isn’t the sole key to happiness, but life is certainly better when you have an abundance of it versus a scarcity. I would thus define winning this game as having an abundance of it versus just scraping by and financially struggling. Among the factors that go into winning the game include: the family you come from, personal (and family) life choices, your financial IQ, personal grit or ambition, delaying gratification and your current environment.

Your financial IQ may be the most important of all the factors I listed, and it can be impacted by the other factors. This concept is covered in numerous books. Your financial IQ includes your ability to earn money, your ability to save money, your ability to invest money, your understanding of credit, your understanding of insurance and understanding taxes. If you’re born into a high financial IQ family, you will likely learn all these principles starting from the crib. If not, you must learn them along the way, if at all. Furthermore, learning them is going to be impacted by your own personal drive and curiosity. For now, let’s focus on many people’s least favorite topic, taxes.

Taxes: What They’re For And Paying Your Fair Share

First, I want to admit that I don’t know everything about taxes. I would highly encourage readers to subscribe to economist, Antony Davies’, YouTube channel entitled Words & Numbers. It’s one of my new favorite channels because it’s not politics driven, but instead economics and facts driven. I’m currently reading his and James Harrigan’s book, Cooperation and Coercion. Upon listening to his content, one of the things that you immediately start to understand is that our politicians are not always honest with us about who pays what and how much in terms of taxes. Furthermore, they’re not always clear about the ramifications for the tax changes they promote. Often, in the pursuit of a political office, they incite class warfare.

In any case, while some taxes are necessary for our municipal, state and federal governments to perform their tasks, there can be too many taxes and they can have harmful effects on everyone. Furthermore, a part of one’s financial health is managing your taxes. The more you read, learn and start understanding about money, the more you start learning that in our ‘progressive’ tax system, not everyone is taxed the same and there are a number of reasons why.

As extensively covered in the Rich Dad Poor Dad books, employees are taxed differently than businesses (small and large). As an employee, your tax burden changes the more earned income you generate, and you start to lose deductions the more your salary increases. In the above-mentioned Rich Dad books, there is a clear distinction between high income professionals and business owners, and each has different rules in our current tax code. As employees, one of your tools for diminishing taxes is tax deductible gifts or donations.

Tax Deductible Giving

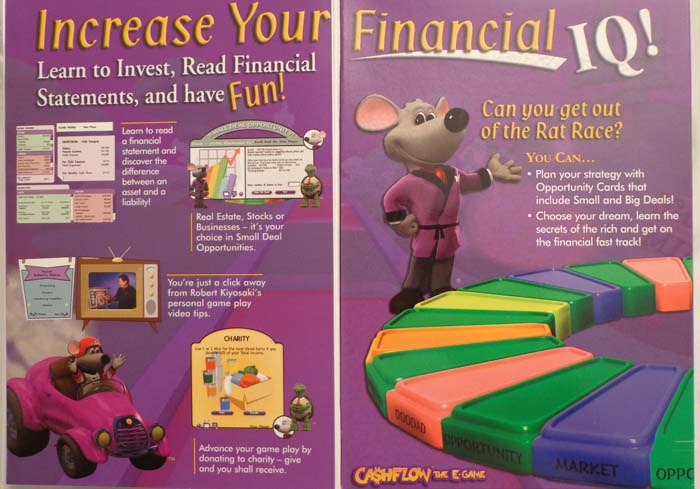

Around the time I moved in with Dad for my postdoctoral fellowship, a couple of things coalesced in my mind in this area. First, I got a copy of the Cashflow 101 e-game which I played regularly on my personal computer. Just briefly, the game is designed to teach you financial literacy and the goal is to get out of the ‘rat race‘ (the realm of working 9-5), and onto the ‘fast track‘, or the realm of the wealthy, where you can live on your investments and pursue your dreams. One of the things I realized when playing the game was that the rat race contained yellow ’donation’ squares. When you landed on those squares, you had the option of donating money.

If you chose this option, you received extra rolls of the dice with multiple dice. I refused the option initially and then realized that there was an advantage to making donations. You also received greater opportunities to earn and invest. Finally you increased your likelihood of passing over ‘downsized’ squares which meant you lost money and turns. The underlying lesson was that you ultimately received rewards for giving. I’m not saying that you should give strictly to get, but in our financial system the government does allow you to write off gifts to certain entities and thus lowering your tax.

“Did you get your taxes done yet? Did you get your taxes done yet? Did you get your taxes done yet?” That’s all I heard the first tax season I moved in with Dad just after finishing graduate school. He literally walked through the house asking me if I had done my taxes. I didn’t know why he cared so much, but it started to scare me. Just finishing my doctoral training, a period in which I didn’t have much money, I owed the IRS tax money that year. For those unfamiliar with the process, we had to pay estimated taxes on our $17,000 to $22,000 graduate stipends every year. So yes, the poor do pay taxes too.

Reducing Your Taxes

“I like to make gifts to things that are tax deductible!” One day we were at Dad’s desk, and he had a pile of solicitations from his alma mater and other charities. He made his poignant declaration as he pondered them. He prepared his tax returns himself at that time and it was quite the ritual every year as I observed him.

In hindsight, Dad was probably also feeling some anxiety himself. He lived in one of the highest taxed states in the country – New York. He also owned his home outright and probably wasn’t going to get much in way of homeowner related deductions. In other words, he was likely going to have to make payments to the federal and state governments.

This explains his preoccupation at that time with tax deductible gifts. Unfortunately, I don’t remember the exact verbiage, but we did have a talk about making charitable gifts to certain entities and lowering your tax payment. It was my first time learning these lessons and I was in my late 20s. I know that my mother put money into church in my younger years, but we never talked about the gifts being tax deductible.

Where Can You Make Tax Deductible Gifts?

Well, I just named a big one which will make a lot of people bristle in our increasingly secular society, church. Whether you want to admit it or not, churches are businesses, some bigger than others. Some also do more good than others. Not all pastors, for example, take the tithes and offerings to the church to buy expensive suits, fleets of fancy cars and private jets. Some churches actually use the money raised for missionary activities and helping the poor.

That said, if you belong to a church and give regularly, you will have the opportunity to deduct at least a portion of that money from your tax liability, regardless of what the pastor and the church do with it once you drop it in the plate or donate online. This also explained why Dad kept giving tithes and offerings to his church even when he stopped physically attending. Each week he dutifully wrote his check and put in the church’s envelope with the same smiley face on it. That smiley face always made me laugh. I or my then stepmother, would take it to the church on his behalf.

If you don’t attend church, what about making donations your alma mater? My alma maters are Johnson C. Smith University and the University of Michigan. Many people make generous donations to their alma maters every year. It’s the consistent donations from alumni that ensure that their alma maters maintain solid futures.

Other institutions experience anemic alumni giving and are not so fortunate, causing them to face a loss of accreditation and/or closure. The Historically Black Colleges and Universities are a good example of this. There are also scholarship funds like the United Negro College Fund. Furthermore, throughout the year and around the major holidays, there are regularly solicitations to feed the hungry, especially around the Thanksgiving and Christmas holidays. When watching TV and now online, there are opportunities to give for pretty much any cause around the world whether it be feeding hungry people, or relief from wars.

Again, giving is a wealth-building and maintenance strategy for certain demographics. Come election time, the wealthy regularly get demonized for not paying their ‘fair share’ of taxes relative to the middle and lower classes. I would once again point readers back to the above-mentioned book Cooperation and Coercion for a more substantive discussion of the validity of these claims. I’ll end this point by stating that the charitable giving and philanthropy these high net worth demographics make isn’t highlighted as much (or enough).

Giving Is A Personal Choice

There are several contexts for giving and generosity. It’s something I’ve had to conceptually piece together over my lifetime. My parents helped. The Rich Dad Poor Dad books helped. Dave Ramsey and his Financial Peace University curriculum helped. Life experiences have contributed as well. It’s been a process.

After finishing school and launching off into the adult world of work, one quickly learns that at any given time there can be multiple financial concerns and considerations pulling at you depending on your lifestyle. Perhaps you don’t earn that much money. Perhaps you’re just starting your career and live in an expensive metropolis. Perhaps you have a large student loan payment or are encumbered with some other massive debt. Perhaps your family is dependent on you as the breadwinner, and not just in the context of a nuclear family. In any case, sometimes you might have your hands full just getting your own financial house in order, and you don’t have money available to give.

It may not make sense to willingly give money away. I think the underlying principle in this world, though, is that when you bless others, you get blessed. As my mother often says, “It’s in the Bible,” and there are numerous scriptures which discuss this such as Proverbs 11:24-26 (Give freely and become more wealthy; be stingy and lose everything. The generous will prosper; those who refresh others will themselves refreshed. People curse those who hoard their grain, but they bless the one who sells in time of need.) If you’re not into biblical scripture, just know that under our current progressive tax code as described above, the Internal Revenue Service (IRS) allows you to deduct monetary gifts to nonprofit entities from your tax liability. And finally, there are advantages to paying fewer taxes or none at all.

Closing Thoughts On Tax Deductible Gifts

Thank you for reading this piece. I didn’t write this narrative to tell anyone how to give as everyone’s life is unique. Furthermore, I am not a financial professional, and I am not rendering advice. My intent is to present the information and let the reader decide. This story was rooted in one of many memorable experiences with my father, a retired educator, and it just so happens that I’m publishing it around Father’s Day 2022. Here on the Big Words Blog Site, most of the content published these days is from customers by way of shorter, informational pieces. As the owner of the site I like to publish something of my own from time to time. I started writing this piece months ago, and with the many other things I have to do, I was only able to finish it now.

Author’s Thoughts/Reflections

Tax deductible gifts are a really big deal, and many people give with their tax liabilities in mind. I’m recalling a couple of our Johnson C. Smith University Washington DC Alumni Chapter meetings where members wondered how their gifts to the school would be handled in terms of tax, if they were given through the chapter itself instead of independently.

We often learn a lot from our parents through observation. Many of the life lessons from my father have been money-related. Many of those lessons have involved being very careful with it which can be a strength in some contexts, while it can be a source of conflict and ire in others. As with most things in life, I’ve learned a balance is good and optimal.

The Big Words LLC Newsletter

For the next phase of my writing journey, I’ve started a monthly newsletter for my writing and video content creation company, the Big Words LLC. In it I plan to share inspirational words, pieces from this blog and my first blog, and select videos from my four YouTube channels. Finally, I will share updates for my book project The Engineers: A Western New York Basketball Story. Your personal information and privacy will be protected. Click this link and register using the sign-up button at the bottom of the announcement. Regards.