While the main areas of my blog are Education, STEM and Financial Literacy, I will occasionally comment on Social and Political topics where I see it appropriate – especially when they relate to principles of my blog – in this case critical thought, and empowering others. This particular topic has the potential to get people fired up due its polarizing nature but I’ve decided to reach my hand into the fire nonetheless. In writing this I’m not seeking to give an opinion that everyone should follow – just to capture the main points and questions from the discussions that have ensued. I have to give credit where it is due in that I decided to write something about this after listening to the YouTube channels of Minister Jap, and Oshay Duke Jackson who weighed in heavily on this – both receiving agreement and backlash from their listeners.

While the main areas of my blog are Education, STEM and Financial Literacy, I will occasionally comment on Social and Political topics where I see it appropriate – especially when they relate to principles of my blog – in this case critical thought, and empowering others. This particular topic has the potential to get people fired up due its polarizing nature but I’ve decided to reach my hand into the fire nonetheless. In writing this I’m not seeking to give an opinion that everyone should follow – just to capture the main points and questions from the discussions that have ensued. I have to give credit where it is due in that I decided to write something about this after listening to the YouTube channels of Minister Jap, and Oshay Duke Jackson who weighed in heavily on this – both receiving agreement and backlash from their listeners.

A very recent and interesting story is former NFL quarterback Colin Kaepernick’s retirement. I won’t go far into who Colin Kaepernick is as his background is available online via a simple Google search. The entire timeline surrounding his retirement is actually captured in an article written by Dan Wetzel of Yahoo Sports titled, “Colin Kaepernick is making his choice: Activism over the NFL”. It was graciously shared by a Facebook friend.

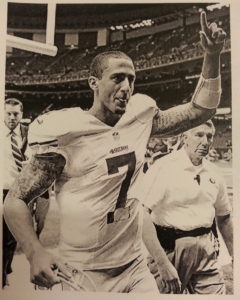

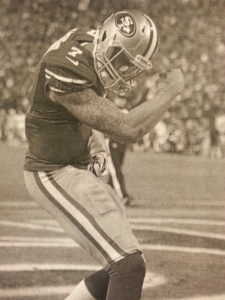

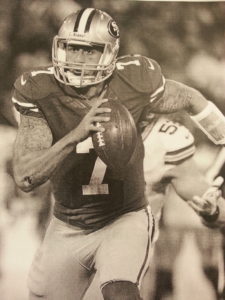

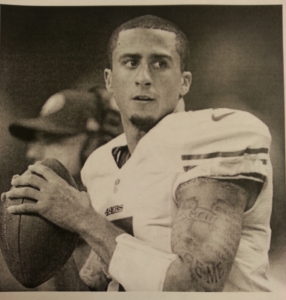

Put simply Colin Kaepernick was a very electric player in the NFL at the quarterback position who had about three great years with the San Francisco 49ers before his career bottomed out into mediocrity. With his combination of size, quickness, mobility and a strong arm, the tattooed signal caller looked like the future of his position. With his good looks and a unique image/persona, he was also destined to clean up money-wise on endorsements, modeling and in the media off the field.

Put simply Colin Kaepernick was a very electric player in the NFL at the quarterback position who had about three great years with the San Francisco 49ers before his career bottomed out into mediocrity. With his combination of size, quickness, mobility and a strong arm, the tattooed signal caller looked like the future of his position. With his good looks and a unique image/persona, he was also destined to clean up money-wise on endorsements, modeling and in the media off the field.

His ascension sputtered though when his brilliance on the field seemed to stagnate and regress which for me was surprising. His decline was mostly due to defenses adapting to his skill set which hadn’t yet evolved to make him more of pocket passer. The departure of Head Coach Jim Harbaugh back to my alma mater also didn’t help, nor did the dismantling of the roster that surrounded him when the 49ers made their run to Super Bowl XLVII. All in all, in the last year or so, even though he signed a $126 million-dollar contract, it wasn’t clear if he still had the skills to play in the league.

As all of the police shootings of black men were caught on tape within the last two to three years (Philando Castile, Alton Sterling, and Walter Scott for example), Kaepernick’s focus seemed to shift from returning to the All-Pro quarterback he had been, to becoming more of a vocal “Social Justice Warrior” championing the causes of police-brutalized African Americans who seemed to be victimized more and more. During the 2016 season, he made the bold protest at the beginning of 49ers’ games at first sitting during our national anthem, and then later on opting to famously take a knee. The reactions to his protests were mixed everywhere. In the league, some players and teammates disagreed with the protest, while others supported him and joined in. Kaepernick further did other things like vocally showing little confidence in our voting/electoral process which makes me wonder in hindsight if his example impacted the 2016 Presidential Election. Many people actually do follow the examples and leadership of celebrities/pro-athletes, and a low voter turnout on the Democratic side was actually said to have helped Donald Trump win the presidency. In another instance Kaepernick took it a step further by wearing socks to practice depicting the police as pigs – perhaps inspired the “Pigs in blanket: fry em like bacon,” chant by Black Lives Matter in Minnesota in 2015.

In my circle of friends, the question came up as to whether or not Kaepernick should’ve been focusing strictly on football and getting back to where he was a couple of seasons ago. It came up a lot actually. The other question was whether or not he was being a distraction to his team and organization, and if he was permanently burning his bridges in the NFL – a traditionally conservative organization which didn’t like controversies and always sought to, “Protect the shield,” as talk show host Jim Rome always says.

In Black America, points of view varied as they normally do with all things political and socioeconomic. The Pro-Black Activists and the “Stay Woke” folks vocally and fervently supported Kaepernick. Others questioned his motives and newfound interest in Civil Rights issues – particularly because he was bi-racial, raised in a white family and never openly took an interest in such issues before – black on black crime for example which some would argue is responsible for more black deaths. As a result of his protest, many also rallied behind the uncovered origins of the Star-Spangled Banner and rejected our national anthem. Something I interestingly missed but that a mentor pointed out, was that our traditionally liberal US Supreme Court Justice Ruth Bader-Ginsburg even disapproved of Kaepernick’s protest which was surprising.

In Black America, points of view varied as they normally do with all things political and socioeconomic. The Pro-Black Activists and the “Stay Woke” folks vocally and fervently supported Kaepernick. Others questioned his motives and newfound interest in Civil Rights issues – particularly because he was bi-racial, raised in a white family and never openly took an interest in such issues before – black on black crime for example which some would argue is responsible for more black deaths. As a result of his protest, many also rallied behind the uncovered origins of the Star-Spangled Banner and rejected our national anthem. Something I interestingly missed but that a mentor pointed out, was that our traditionally liberal US Supreme Court Justice Ruth Bader-Ginsburg even disapproved of Kaepernick’s protest which was surprising.

But what would be the outcome of Kaepernick’s protests? What good would come of them? He may have been, “Following is heart,” as said by a cousin on Facebook, but were his actions the best thing for him and the people he was looking to help? Some felt that Kaepernick had “won” because he had gotten people talking about him and his protests. Whether or not they would affect real change remained to be seen.

Fast forward to this summer of 2017 – Kaepernick, now a free agent had one tryout with the Seattle Seahawks who ultimately didn’t sign him leading to his retirement announcement. I heard about his retirement on the above mentioned shows where the discussions got very heated. Some of Minister Jap’s listeners for example called him all kinds of names like, “Klansman”, in addition to today’s en vogue black on black slur, “Coon”. The comments in both shows were surprisingly split down the middle in rebuke of Kaepernick vs. rebuking the hosts.

Whatever happens to Colin Kaepernick, I hope that he lands on his feet somewhere and there is a happy ending to his story unlike what some others are predicting. A couple of points stand out to me from Kaepernick’s retirement and the discussions I’ve listened to surrounding it. They are:

- For all the younger people witnessing this, think about the long-term effect on your life and job prospects when seeking to make political/social statements. Ask yourself if it is really worth it in the end? Is it the appropriate time? In other words there are consequences to our actions. My former stepfather once told me that a particular black activist back in Buffalo made quite a few blacks in the city “self-destruct” and self-sabotage their careers. In a way the title of the above mentioned Yahoo Sports article is deceptive in that it sounds as though Kaepernick is highly coveted and doesn’t want to play anymore, versus not being wanted by any of the NFL’s 32 franchises.

- Change and power in the United States is economic and only minimally impacted by protests and marches. If Kaepernick will no longer command a million-dollar salary and endorsements in addition to his former platform, how will he now effect meaningful change for those he wants to help? One of the arguments on the above mentioned shows was that he could’ve used his salary to build businesses and employ other blacks to make real change – similar to Magic Johnson who has done quite well since his playing days.

- Not all black people think alike on anything. Issues over politics and race divide and fragment the race a whole. The fallout and name calling whenever there are differences of opinion are always striking to me.

- Lastly even in 2017, there is a genuine distrust of bi-racial blacks by other blacks – particularly those raised in predominantly white households, who then take pro-black stances when it appears to be convenient.

One of the talk show hosts stated that at some point reality will crash down hard on Colin Kaepernick – if and when his resources are depleted, he’ll be forgotten – similar to what happened to MC Hammer once all of his resources were spent. Likewise, the same people he is seeking to help will eventually turn their backs on him even after some of his gestures of generosity such as giving suits to felons. Again, my hope is that he has thought all of this out, and will have a productive life after football. For that stretch of two to three years, #7 was definitely a great one in my opinion.

One of the talk show hosts stated that at some point reality will crash down hard on Colin Kaepernick – if and when his resources are depleted, he’ll be forgotten – similar to what happened to MC Hammer once all of his resources were spent. Likewise, the same people he is seeking to help will eventually turn their backs on him even after some of his gestures of generosity such as giving suits to felons. Again, my hope is that he has thought all of this out, and will have a productive life after football. For that stretch of two to three years, #7 was definitely a great one in my opinion.

Thank you for taking the time to read this post. If you enjoyed this you, you might also enjoy:

• Are you Cooning? Thoughts on Black America’s new favorite racial slur, critical thought, and groupthink

• What are you doing with your tax cut? Thoughts on what can be done with heavier paychecks and paying less tax

• Challenging misconceptions and stereotypes in class, household income, wealth and privilege

• Challenging misconceptions and stereotypes in academic achievement

• The benefits and challenges of using articulate speech

• Who will benefit from Apple’s $350 billion investment?

If you’ve found value here and think it would benefit others, please share it and or leave a comment. To receive all of the most up to date content from the Big Words Blog Site, subscribe using the subscription box in the right hand column in this post and throughout the site. Lastly follow me on Twitter at @BWArePowerful, at the Big Words Blog Site Facebook page, and on Instagram at @anwaryusef76. While my main areas of focus are Education, STEM and Financial Literacy, there are other blogs/sites I endorse which can be found on that particular page of my site.

This is the conclusion of my interview of Simone Griffin of

This is the conclusion of my interview of Simone Griffin of