“Over your lifetime, you’ll actually miss more deals than you’ll catch onto.”

“Over your lifetime, you’ll actually miss more deals than you’ll catch onto.”

Two of the principles of my blog are “Long-Term Thinking/Delayed Gratification”, and the teaching of “Financial Literacy” as money and investing are topics that I ponder and study quite a bit these days. I wasn’t taught a lot about them as a youth and strive regularly to fill that space in my personal toolbox. Learning about investing money is actually critical for all employees who are responsible for saving into their own “Defined Contribution” plans. A third principle of my blog is “Creating Ecosystems of Success” – helping others to be successful. This particular story involves all three principles and focuses on two investing opportunities from years past – both of which could have drastically changed my life today if I had been in position to take advantage of them.

This post was inspired by two people. One is a mentor who has literally adopted me and whom I regularly meet with to talk about the content of my blog, economics, current events and everything else under the sun. Everyone should have a mentor like this. The second individual is a long-time friend from our hometown of Buffalo, NY. He worked in the banking industry, and has always had a bit of an entrepreneurial mind.

Instead of diving right into the story, for context I’ll go back to my brief high school basketball career – one of the best times of my life. One of the things our coaches tried to stress to us was “boxing out” on defense. That is putting a body on your man once a shot went up from the opposing team. By committing to boxing out as a team, any team almost certainly could position itself to get the rebound and limit shot opportunities for the opponent no matter their height or leaping ability. It was a simple and effective technique if used consistently and for our young minds, that was the hard part – doing it consistently. All it took was being mentally alert, and positioning oneself at the right time.

Okay, let’s talk about Facebook and Bitcoin. I’ll start with a reading assignment my mentor gave me about three months ago. One of the topics we discuss regularly is investing money – something he is very experienced at and has taught his kids to do – something I’m playing catch up on.

Okay, let’s talk about Facebook and Bitcoin. I’ll start with a reading assignment my mentor gave me about three months ago. One of the topics we discuss regularly is investing money – something he is very experienced at and has taught his kids to do – something I’m playing catch up on.

At the conclusion of one of our mentoring sessions, he gave me a book to read titled “How To Turn $100 Into $1,000,000: Earn, Save and Invest” by James McKenna and Jeanine Glista with Matt Fontaine, the creators of Biz Kid$. When he first handed me the book, I made a comment about it being a, “Children’s book,” to which he quickly snapped back at me, “Do you know everything thing in this children’s book?” Eager to know more of what he knew, I didn’t take offense, but instead appreciated his coaching. He tasked me with reading the book prior to our next mentoring session.

As I read through the book, the initial chapters started with basic money lessons youngsters should have – ways to legally earn money such as through doing chores or eventually getting a job, and also planning and goal setting – some lessons many children aren’t taught at an early age. Later the book delved into investments in a very simple and digestible way – charts, diagrams, pictures and all. One caption that stood out for me was something on page 106, which told the story of Facebook’s Initial Public Offering (IPO) back in 2012.

“We should all pool our money together and buy Facebook stock,” my friend described earlier said enthusiastically. It was the holiday season up in our hometown of Buffalo, NY. He had worked in the banking industry for a while and had knowledge of investment vehicles that myself and my brother, and probably most of his family didn’t have.

“We should all pool our money together and buy Facebook stock,” my friend described earlier said enthusiastically. It was the holiday season up in our hometown of Buffalo, NY. He had worked in the banking industry for a while and had knowledge of investment vehicles that myself and my brother, and probably most of his family didn’t have.

We were all at his grandmother’s house where his relatives gathered to fellowship as they did most years. I watched as he floated around his grandmother’s upper unit telling everyone, “We should pool our money and buy some Facebook stock. They’re about to have an IPO.”

At that point, Facebook had completely eclipsed Myspace as the number one social media site and most everyone was on it. While most everyone was using it to reconnect, share the most intimate details of their lives, and other unscrupulous things, its creator Mark Zuckerberg, was cleverly devising ways to monetize his creation through selling advertising space. It never occurred me, and I would guess the majority of the users, to invest in it.

A mischievous guy at times, I thought this was just another one of my friend’s bright ideas that he was trying to suck us all into. But was it? As described in How To Turn $100 Into $1,000,000, Facebook’s initial stock price in 2012 opened at $38 per share. Shortly thereafter the stock price decreased to $17.55. When I heard that the stock price went down, I laughed internally at the prospect of all of us “pooling” our money to buy this Facebook stock, and the fact that my friend was lobbying so hard for us to do it. But that was just the beginning.

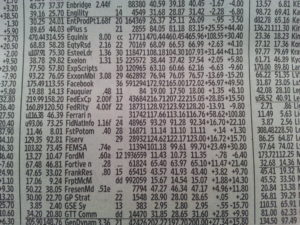

Facebook’s stock rebounded over the next five years from that $17.55 per share drop and eventually appreciated to around $100 per share in 2015 when How To Turn $100 Into $1,000,000 was published. Just before crafting this piece, I checked the business section of the Washington Post for stock prices and to gauge the health of our economy – a regular exercise now. There I saw that Facebook’s stock is now trading around $170 per share, that’s right $170. It’s also now considered one of the “Four Horseman” of technology stocks – the other three being Amazon, Apple, and Google.

Facebook’s stock rebounded over the next five years from that $17.55 per share drop and eventually appreciated to around $100 per share in 2015 when How To Turn $100 Into $1,000,000 was published. Just before crafting this piece, I checked the business section of the Washington Post for stock prices and to gauge the health of our economy – a regular exercise now. There I saw that Facebook’s stock is now trading around $170 per share, that’s right $170. It’s also now considered one of the “Four Horseman” of technology stocks – the other three being Amazon, Apple, and Google.

So let’s put this all in perspective. What occurred to me when I read that passage in the book was that if I simply had $2,000 lying around and ready to invest in 2012, I could’ve purchased just 100 shares of the Facebook stock for a total value of $1,755 (plus the cost per trade). Holding onto that stock for another five years, those 100 shares would have appreciated to a total value of $17,550 which could either be cashed out for another purpose, or held for more appreciation. There would of course be the potential of loss too as with all investments, but Facebook has become a very strong company. But if you were positioned to get into the game at that point, you would’ve been rewarded later on.

I’ve come to realize that life is all about positioning similar to the way smart basketball players position themselves to get rebounds when a shot goes up, as opposed to simply leaving things to chance. When I look back to where I was in 2012, I honestly wasn’t in position to safely buy stock of any kind. I was still lugging around a considerable amount of debt from school, and from mistakes made shortly after starting my federal career – paying too much money for some real estate investing trainings (discussed in another post). I was recently out of a tumultuous relationship where money was an issue – my not spending enough.

I further had no Emergency Fund (see Dave Ramsey), and I hadn’t started funding my government retirement plan at least up to the point where I would get my 5% matching contribution – something all employees should position themselves to do if employers offer it. What’s more is that I didn’t understand much about the stock investing game other than you want to “buy low” and “sell high” whether or not you get into an opportunity when it’s first offered, or if you find something of value at a discounted price and chances are it will appreciate – stocks, real estate, whatever. By the way, to see why it’s critical to have an Emergency Fund and to be prepared for disasters, I recommend reading An In-Depth Guide to Financial Emergency Preparedness by Brian Robson.

But there is so much more to it than buying low and selling high. There are lessons which take time and commitment to learn – this is part of positioning one’s self. Furthermore, there are often sacrifices to be made to have money to invest – sacrifices such as not buying a car if public transportation and Uber can be used, taking one’s lunch to work more often times than not, and not “Turning Up” at the club on a regular basis. As a man, another position might be not having a girlfriend for a while, or at least finding one who isn’t high maintenance. These are examples of the positioning one must do to be ready to take advantage of the next Facebook if and when it ever comes around.

But there is so much more to it than buying low and selling high. There are lessons which take time and commitment to learn – this is part of positioning one’s self. Furthermore, there are often sacrifices to be made to have money to invest – sacrifices such as not buying a car if public transportation and Uber can be used, taking one’s lunch to work more often times than not, and not “Turning Up” at the club on a regular basis. As a man, another position might be not having a girlfriend for a while, or at least finding one who isn’t high maintenance. These are examples of the positioning one must do to be ready to take advantage of the next Facebook if and when it ever comes around.

My friend was right in that it would have been good for us to take advantage of the Facebook IPO. Coincidentally a couple of years later, he came back to us and told us that we should take advantage of something called “Bitcoin”, a new cyber-currency which I thought was another one of his silly ideas. Years later I would learn that it ran off of something called “Blockchain” technology. He was very enthused about it, but one of the issues was he couldn’t clearly explain to us what Bitcoin was and why it was important going forward. This brings up another very key point. A very important investing rule of thumb is that one should never invest in something they don’t understand. It turned out though that he was right again. Two to three years later, Bitcoin seems to be paying off for those who positioned themselves and invested in it when it was dirt cheap. See the recurring theme here?

This post is not about buying Facebook or Bitcoin today in 2017 per se. Those ships have arguably sailed, and you’d have to have enough money readily available even just to buy 10 shares of Facebook stock today. In terms of getting into these opportunities early when they’re affordable, you have to position yourself, and that’s the central point. Either you’re in a position to take advantage of an opportunity when it’s presented to you, or you’re not. You must be prepared.

This involves knowledge and resources. Study your investment of choice, minimize your debt, save for emergencies, and then allocate your money to invest – money you won’t be adversely affected by the if the investment doesn’t work.

If you’re not in a position to take advantage of a particular opportunity, you can always position yourself for the next one, and the one after that, and then the one after that. It’s all about foresight and positioning. Before starting discretionary/speculative investments, it might also be worthwhile to see a trustworthy financial planner (or someone knowledgeable whom you really trust) who can make sure you’re on sure footing. They may be able to give insight into what type of investments are best for your particular financial goals. Click here if you want to know more about your options.

For the people who were in position to get into Facebook and Bitcoin, it wasn’t magic. They had the resources and they were probably spending time studying those opportunities so that they were able to strike at the right time. It all takes some time and effort, and how you spend your time will determine if you’re in position to take advantage of the next Facebook. In closing, I highly recommend How To Turn $100 Into $1,000,000 to youngsters who have the aptitude for money and finance, and for adults like myself who’ve needed to play catch up. I’ve personally started sharing copies with those in my inner-circle.

For the people who were in position to get into Facebook and Bitcoin, it wasn’t magic. They had the resources and they were probably spending time studying those opportunities so that they were able to strike at the right time. It all takes some time and effort, and how you spend your time will determine if you’re in position to take advantage of the next Facebook. In closing, I highly recommend How To Turn $100 Into $1,000,000 to youngsters who have the aptitude for money and finance, and for adults like myself who’ve needed to play catch up. I’ve personally started sharing copies with those in my inner-circle.

Thank you for taking the time to read this post. If you enjoyed this one, you might also enjoy:

• Your net worth, your gross salary, and what they mean

• The difference between being cheap and frugal

• A look at STEM: Blockchain technology, a new way of conducting business and record keeping

• A Cryptocurrency App Case Study

• Why SEO really is the key to a successful online business

• The Best Apps for Crypto Investment

• Who will have the skills to benefit from Apple’s $350 billion investment?

If you’ve found value here and think it would benefit others, please share it and/or leave a comment. To receive all of the most up to date content from the Big Words Blog Site, subscribe using the subscription box in the right hand column in this post and throughout the site, or copy the link to my RSS feed into your feedreader. Please visit any of my Big Discussions76 YouTube channels. You can follow me on the Big Words Blog Site Facebook page, and Twitter at @BWArePowerful. Lastly, you can follow me on Instagram at @anwaryusef76. While my main areas of focus are Education, STEM and Financial Literacy, there are other blogs/sites I endorse which can be found on that particular page of my site.

“Over your lifetime, you’ll actually miss more deals than you’ll catch onto.”

“Over your lifetime, you’ll actually miss more deals than you’ll catch onto.” Okay, let’s talk about

Okay, let’s talk about  “We should all pool our money together and buy

“We should all pool our money together and buy  Facebook’s stock rebounded over the next five years from that $17.55 per share drop and eventually appreciated to around $100 per share in 2015 when

Facebook’s stock rebounded over the next five years from that $17.55 per share drop and eventually appreciated to around $100 per share in 2015 when  But there is so much more to it than buying low and selling high. There are lessons which take time and commitment to learn – this is part of positioning one’s self. Furthermore, there are often sacrifices to be made to have money to invest – sacrifices such as not buying a car if public transportation and

But there is so much more to it than buying low and selling high. There are lessons which take time and commitment to learn – this is part of positioning one’s self. Furthermore, there are often sacrifices to be made to have money to invest – sacrifices such as not buying a car if public transportation and  For the people who were in position to get into

For the people who were in position to get into