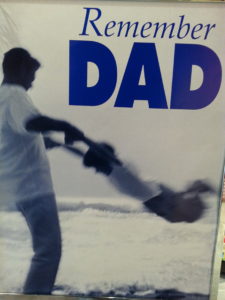

Last month I wrote a piece in celebration of Mother’s Day, so it’s only fitting that I write something in celebration of Father’s Day as well. The Mother’s Day post was about a specific piece of advice my mother gave me about my engagement and looming marriage a couple of years ago. As jokingly stated in that post, Dad didn’t give me much advice in that particular instance. He did give me lots of guidance throughout my life though. Over on my “Heroes and Quotes” page, his is the first quote which was some advice he gave me at a young age about how to succeed academically.

There was much more though, particularly in way of advice about money, women and other things – lots about money and women. He sometimes consciously taught me things, and some things I learned simply from observation. With two of the key principles of my blog being “Creating Ecosystems of Success”, and “Empowering Others”, I’m going to reflect on some of his money lessons and some of their deeper and associated life meanings/significances – some of which I had to question. As in most cases, I didn’t understand everything that was being said then as I do now.

As I go through some of this stuff, keep in mind that fathers are important – biological, step-, or mentors of all sorts. According to data from Kid’s Count in 2015, 66% of African American kids were raised by a single-parent while the national average was 35%. My parents divorced when I was three-years old and I thus grew up in a single-parent household for the majority of my childhood. While I’ve sometimes looked back and wondered what it would’ve been like to have my father in the house, the blessing was that while he wasn’t physically there, it was important for him to be as visible and accessible as possible.

“Always make sure your children know who you are.” He tried hard to keep up with the words of his own father who died during his teens. It sounds like a simple thing, but as I grew into adulthood myself, went through college and even started dating, I realized that not every father did this, especially in the black community. The results often times were catastrophic with long lasting ramifications, especially in dating or ‘pair-bonding’ – a separate topic all in itself.

* * *

“You just did something I don’t like. You didn’t count your change. How do you know that the cashier gave you the correct change?” I was an early teen when this discussion took place. I had just paid for something, took the change the cashier gave me and immediately stuffed it into my pocket. A stern man, his words, “You just did something I don’t like,” stopped me dead in my tracks. I didn’t think he was paying attention, but sure enough he was – in general Dad was always paying attention to the most minute details even when you thought he wasn’t. He also remembered things long after you forgot them and would bring them back up when you least expected it.

When I discovered what he was unhappy about, it made sense to me and I started counting my change. I even started calculating in my mind the change I was supposed to get back from cashiers before they gave it to me. The lesson here was to be careful with my money, and to trust no one. Years later he observed that I was in fact careful with my money. I told him that I had gotten the behavior from him. He replied saying something very profound, “Well son, when you have to make child support payments, you have to be very careful with your money.”

“You always keep your receipt because you never know when you’re going to have to return something.” I don’t know which came first, this lesson or the change counting lesson, but they weren’t far apart. His father had gotten on him about this when he was younger. He had allegedly gone into lower Manhattan to buy some underwear and returned home without the receipt resulting in his getting scolded.

“When you get paid, you want to account for all of your expenses.” This was an early lesson about budgeting. We didn’t sit down and do one right then and there, and I wouldn’t master it until at least ten years later, but I always remembered the discussion.

“You always pay yourself first.” This lesson came shortly after I started working, though again as a teen, I didn’t grasp the power of this advice until later. It had tremendous implications in one’s prime earning years where diligent individuals save for both emergencies and investments and build wealth while others spend all of their income.

“You don’t quit your job unless you have another one to go to.” Dad gave me this sage wisdom between my junior and senior years of high school after quitting my very first job at the Denny’s Restaurant, near the Buffalo airport. I lasted three months at that job which consisted of washing dishes, cleaning up the restaurant, and taking out the garbage. I didn’t last long enough to have to shovel snow in the winter. The place where I really wanted to work for my first job was McDonald’s. At the time it looked fun to me. I was happy to have an income, but after a while I grew tired of working at Denny’s – coming home sweaty, greasy, and exhausted. Without talking to anyone, I quit that job right there on the spot with no other job to go to. It was then that I came to the understanding that I had no more cash flow – a sign of immaturity. The only positive thing about that situation was that I was still in high school and wasn’t required to contribute to any of my mother’s household bills. Some adults quit their job without having a replacement and put themselves in a pickle; often burdening those around them.

“You always keep money in the bank because you never know when an emergency is going to arise.” There’s a very funny story behind this lesson and it involves a woman – something very dramatic and stressful according to Dad. For my own safety, I’ll just stick to the lesson. At an early age, Dad stressed the importance of having money in the bank due to unforeseen emergencies which inevitably happen to you, or to someone around you. In this particular quagmire he had gotten into, having some money in the bank helped him get out of it. He also regretted once not having $5,000 available for a mortgage down payment on a house he was renting.

“You can keep dating her if you want to. You might have to miss your electric bill.” This sobering advice came during my first year in graduate school in my mid-twenties. It was one of my first experiences learning something that Dad had talked about for most of my childhood – women and money. At least most of the ones we knew came with a price tag, and wanted to be wined and dined.

I had, unfortunately, taken a liking to someone whom I dated for one to two months who openly admitted she was needy, which I didn’t understand at the time as she had already started her own career. Inexperienced at dating, she grew frustrated with my meager finances and my lack of understanding of what was expected of me. Dad’s advice here, which came in a hurtful and mocking tone, was simply communicating that I needed to determine whether or not I could afford this particular female. I decided that I couldn’t.

It’s an important set of questions for all men to ask themselves when meeting a potential partner. Can I afford her? Does she line up with my priorities? Will she tank my finances? This was also one of the first times I could personally feel the pain, the scars, and the poor fortune my father experienced in the dating jungle after he and my mother split – as there was lots of despair, and little hope or encouragement in his words.

“When you have to make child support payments, it forces you to be very careful with your money.” I have to be very careful here as this is a sensitive topic, and my mother generally proof-reads my articles. Throughout my childhood, Dad sometimes lamented about making child support payments – not because he didn’t want to support his children, but because I think he had a hard time making ends meet on his own end. During my childhood, he eventually took a second job in the military to pay the bills. It’s a sensitive topic because while he felt maxed out, my mother felt as though he wasn’t doing enough. And I’ll stop there, but suffice it to say that in many instances men and women see money (and life) differently. In some instances, as the ones being asked to provide, it can seem like your best is never enough – a hard pill to swallow. He and I talked about this a lot as I got older and I started experiencing my own scrapes and bruises with the opposite sex.

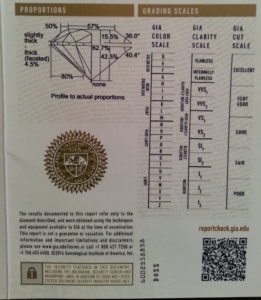

“The bank is going to want to look at all of your bank statements when you apply for a mortgage, and $2,000 isn’t any money,” Dad scoffed at me, making me feel five feet tall. I was still living with the big guy during my Postdoctoral fellowship. I had started reading Robert Kiyosaki’s Rich Dad Poor Dad series and had joined my local Real Estate Investment Club. I wanted to make an ambitious move and get my first investment property – a duplex which I would live in and eventually rent out for “Passive” income. I needed some help with the closing costs and associated expenses, so I asked him for a loan. It was one of the worst experiences of my life.

Instead of a nice teachable discussion about the ups, the downs, and the ins, and outs of trying such a thing – it turned into him putting me in a proverbial headlock. It dragged on for days and days as he mulled over it, and asked me random pointed questions about it – his analysis and communication styles. After a while I just wanted to drop the whole thing, and I concluded that I never wanted to be in a position to ask his help for anything money-related, though I did once more, and returned to the same conclusion.

In hindsight while it was smart to want to create a passive income stream, it wasn’t a good idea in that particular instance. I wasn’t going to stay in that area long-term, and I wasn’t experienced enough, and didn’t have enough money to manage a property from a long-distance. What was funny was that many people don’t even have $2,000 in the bank they can access quickly. That said, he was right in that it wasn’t a substantial amount of money. He was also right in that prior to qualifying you for a mortgage, the banks do want to know everything about your financial history.

Dad was also jaded in terms of being a landlord from a prior experience, as he once had a tenant in his lower unit – an older woman. According to him, he went downstairs to collect the rent one day, and the woman transformed into a malevolent, ominous, and demon-possessed state. It scared him at the time and forever soured him on being a landlord.

“I wouldn’t invest in the Stock Market if I were you.” This bit of advice was given to me in my 30s when I expressed that I wanted to buy some stock by the end of that particular year. Because of his own life experiences, Dad was averse to losing money. Coincidentally, one of our closest cousins recommended I get in the game and buy stock, and even today experts like Dr. Boyce Watkins, strongly advocate blacks getting into the Stock Market. So who was right in this case? Who was to be believed and trusted?

This gets back to one of the points I made in my 2017 Mother’s Day post. As we grow into adulthood, I think we all get to a point where everything our parents tell us can’t be taken as the gospel and in some instances must be questioned and or pondered critically. In this particular instance, yes investing in stocks does involve potential loss. An important consideration going in though is whether or not you understand that there is a potential for the loss, and whether or not you can absorb the loss. In other words, do you have emergency money in the bank, and is the amount to be invested allocated for that reason? Can it be easily replaced for another round? This is a much different thought process than simply stating, “You’re going to lose your money if you do that.”

* * *

If the tone of this blog post was in part melancholy and mixed, then it reflects our father-son relationship which has been full of contradictions and mystery. When I look back at my youth many of my childhood experiences were marked by concerns over money. I’m not saying that I grew up in poverty because I didn’t by any means. I don’t really remember my mother, whom I spent the majority of my childhood with, talking about money a lot, but I think she shielded my brother and me from some things – sheltering us, as one of my aunts often said. I did look around at peers, such as my best friend and realized that I didn’t have Air Jordans, Starter Jackets, Karl Kani, or any of the trendiest apparel of our cohort.

Most of the money-related talks as I grew up actually came from my father and as you might have gathered from this post, many of them had some sort of pain associated with them. As I’ve gotten older, I understand things much better now. As we get older we start to see that our parents are people who make mistakes themselves, and are not perfect though at one point we may have thought they were. In some instances we start to understand their pains and struggles.

Over the years our father-son relationship has gone through a lot of changes – some good and some bad with multiple ups and downs. Overall I’m grateful for everything my father has done for me, and I tell him that every time I see him now (my mother too). That said, as I think President Obama said years ago, for children whose biological fathers are missing, there can be other fathers too. And even if a child’s father isn’t a good one, or can’t supply everything needed, there can again be other fathers to fill in those gaps. I certainly have many.

There are a lot of podcasts and men’s stations on places like YouTube these days – many talking about the importance of fathers. My favorite in this current station of my life is Paul Elam’s “A Voice for Men” – content I would recommend for any man still figuring things out in our society – personal values, dating and marriage, and finally gender/societal roles. Fathers are very important if for no other reason than to lend a balanced perspective on the world. This is true for both boys and girls who themselves will eventually both grow into men and women.

Thank you for taking the time out to read this blog post. If you enjoyed this post, you might also enjoy:

• Two well-behaved boys left to figure things out on their own: Reflections on growing up ‘Blue Pill’

• Mother’s Day 2018: Memories of my grandmothers

• Mother’s Day 2017: One of my mother’s greatest gifts, getting engaged, and avoiding my own personal fiscal cliff

• Challenging stereotypes and misconceptions in academic achievement

• The benefits and challenges of using articulate speech

The Big Words LLC Newsletter

For the next phase of my writing journey, I’m starting a monthly newsletter for my writing and video content creation company, the Big Words LLC. In it, I plan to share inspirational words, pieces from this blog and my first blog, and select videos from my four YouTube channels. Finally, I will share updates for my book project The Engineers: A Western New York Basketball Story. Your personal information and privacy will be protected. Click this link and register using the sign-up button at the bottom of the announcement. If there is some issue signing up using the link provided, you can also email me at bwllcnl@gmail.com . Best Regards.

This is the conclusion of my interview of Simone Griffin of

This is the conclusion of my interview of Simone Griffin of  A couple of years ago when still writing for the Examiner, I wrote a sentimental tribute piece about my mother for

A couple of years ago when still writing for the Examiner, I wrote a sentimental tribute piece about my mother for

“It’s the custom for the bride’s father and or family to pay for the wedding.” I don’t know that my mother knew that her words would stay in my mind as they did. The words made more and more sense to me as I thought about them. From a logical standpoint, if I as a man have just saved for an engagement ring – a month’s salary or more, does it now make sense to dump more money into a one-day extravaganza leaving us financially exposed? For me at the time, no, it didn’t make any sense. By the way, this wasn’t the only advice my mother gave me. As a spiritual woman, there was much more. My father? He didn’t give me much of anything advice-wise. His greatest anxiety/concern was having to fly out to the west coast to attend the ceremony.

“It’s the custom for the bride’s father and or family to pay for the wedding.” I don’t know that my mother knew that her words would stay in my mind as they did. The words made more and more sense to me as I thought about them. From a logical standpoint, if I as a man have just saved for an engagement ring – a month’s salary or more, does it now make sense to dump more money into a one-day extravaganza leaving us financially exposed? For me at the time, no, it didn’t make any sense. By the way, this wasn’t the only advice my mother gave me. As a spiritual woman, there was much more. My father? He didn’t give me much of anything advice-wise. His greatest anxiety/concern was having to fly out to the west coast to attend the ceremony.

This article is a continuation of my interview with Simone Griffin of HomeFree-USA regarding homeownership and the African American community. In

This article is a continuation of my interview with Simone Griffin of HomeFree-USA regarding homeownership and the African American community. In

One of the goals of the Big Words Blog Site is to discuss Financial Literacy-related topics, particularly as they relate to the African American community. A key aspect of wealth building is homeownership. Coincidentally, for my very first interview for the site, I had the privilege of interviewing the very knowledgeable Simone Griffin of

One of the goals of the Big Words Blog Site is to discuss Financial Literacy-related topics, particularly as they relate to the African American community. A key aspect of wealth building is homeownership. Coincidentally, for my very first interview for the site, I had the privilege of interviewing the very knowledgeable Simone Griffin of  Around 2012, two friends introduced me to Dave Ramsey’s

Around 2012, two friends introduced me to Dave Ramsey’s  AD: From your testimony at the tour stop, it sounds as you were pretty deep into the real estate investing world and experienced a lot of success, which is a lot of further than I ever got. I did some learning, but never got any deals done. Based upon your experience, once someone’s life becomes “Financially Peaceful”, would you recommend that arena for someone else? Once you get out to

AD: From your testimony at the tour stop, it sounds as you were pretty deep into the real estate investing world and experienced a lot of success, which is a lot of further than I ever got. I did some learning, but never got any deals done. Based upon your experience, once someone’s life becomes “Financially Peaceful”, would you recommend that arena for someone else? Once you get out to  CB: I have an interesting story. This is pretty cool. I did not have a dad growing up. I actually had four fathers who were all violent and we were always running away from them, from abuse shelter to abuse shelter. So I didn’t have a dad and my Mom, because she was a single, Mom was always working three jobs and was never home. So I really raised myself, but I say that liberally because I’d be sitting in an apartment with no food and no furniture for days at a time completely bored stiff, but the one thing I did have was my Yellow Sony Walkman; if you remember from all the way back in the day before the

CB: I have an interesting story. This is pretty cool. I did not have a dad growing up. I actually had four fathers who were all violent and we were always running away from them, from abuse shelter to abuse shelter. So I didn’t have a dad and my Mom, because she was a single, Mom was always working three jobs and was never home. So I really raised myself, but I say that liberally because I’d be sitting in an apartment with no food and no furniture for days at a time completely bored stiff, but the one thing I did have was my Yellow Sony Walkman; if you remember from all the way back in the day before the