Around 2012, two friends introduced me to Dave Ramsey’s Financial Peace University – a faith based curriculum for managing one’s finances and achieving financial security and stability. I had heard of Dave Ramsey before and knew that he had a radio show, and maybe had written some books. I admittedly was suspicious that it was potentially another Multi-Level Network Marketing business proposal.

Around 2012, two friends introduced me to Dave Ramsey’s Financial Peace University – a faith based curriculum for managing one’s finances and achieving financial security and stability. I had heard of Dave Ramsey before and knew that he had a radio show, and maybe had written some books. I admittedly was suspicious that it was potentially another Multi-Level Network Marketing business proposal.

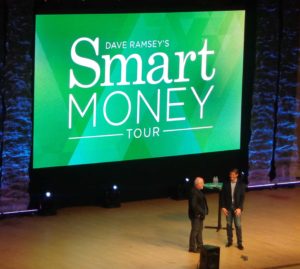

It turned out to be something very different, and four years later it has changed my own finances and life, and I also help out with the Financial Peace Ministry at the Alfred Street Baptist Church. The following interview was published on the Examiner shortly after Dave Ramsey’s Washington, DC Smart Money Tour stop in the spring of 2016. There I met Chris Brown who took the stage along with Dave that night, and was subsequently granted an interview.

* * *

On April 21, 2016, talk show host Dave Ramsey and his team visited Washington DC for one of his many Smart Money Tour stops. That evening, Ramsey shared the stage with a member of his team, Chris Brown. This Chris Brown, however, is not the controversial recording artist who shares the same name as they joked that night, but instead he is the host of the True Stewardship talk show. Shortly after the tour stop Chris granted an interview to talk about his background, his True Stewardship talk show, and Financial Peace.

Anwar Dunbar: Hello Chris. We met briefly just after the Washington DC tour stop when you took the time out to talk to all of the current and prospective Financial Peace University (FPU) coordinators in the audience. I really appreciate the opportunity to follow up with you and talk a little bit more.

Just a little bit about me for some context here. I’m a coordinator in the Financial Peace Ministry at the Alfred Street Baptist Church in Alexandria, VA. When I start with a group these days, as part of my personal story, I tell them first and foremost that I have a Ph.D. in Pharmacology from the University of Michigan. I share that at one point in my life I thought being a “Dr.” would be the key to having a good comfortable life.

In the sciences, a Ph.D. typically commands a significant income. It wasn’t until after I completed my doctorate, got my first job and made some money mistakes that I realized the degree by itself, while definitely an accomplishment, didn’t put me where I wanted to be in life. There were a lot of aspects to the financial world and money that I just didn’t understand, and several lessons that I hadn’t been taught.

At the end of the DC Tour Stop, you took some time to acknowledge the FPU coordinators in the audience. Did you start off as a coordinator yourself? How did you get to your current position where you’re working with Dave Ramsey and hosting your own talk show?

Chris Brown: Yes, I remember meeting you. Well, I think it was important that I had a background in Financial Peace University, and whether or not I was a coordinator or had been to a class, I think that it’s important that whenever you’re going to be representing a philosophy and a way of life – you’ve got to know that you’re behind it and living out what you say. So I think that’s important.

Whether or not I was a coordinator, I don’t think that would’ve mattered. I’ve never personally coordinated a class. I’ve been in several of them. I’ve actually led at a church and my role was to make sure that we had several coordinators and that they felt equipped. So for me, I went from attending a couple of Financial Peace classes to making sure that several of them happened at my church. I kind of skipped over the coordinator piece.

AD: So you must of have distinguished yourself in such a way that you got to meet and work with Dave Ramsey. How did that all come about?

CB: Yes. I view my role at Dave Ramsey Solutions not as a platform thing. It’s more of a calling. We lead out, Dave and myself in particular, with our mistakes, not necessarily as experts. It’s more of a vulnerability of saying we have been successful, but more than that what people are actually relating to is that we have failed, and that’s what people are resonating with the most. We’ve applied biblical principles and they’ve worked, and we’ve applied non-biblical principles and they haven’t worked. And so we’ve seen both worlds, so we lead out with our vulnerabilities and our huge mistakes.

AD: How long have you been doing your True Stewardship talk show? When did that start?

CB: It’s been about a year. Dave has always had a passion for stewardship which is managing God’s blessing, God’s way for God’s glory. It’s deeper than just financial principals, the Xs and Os, and the mathematics. It’s more of we’ve been entrusted with resources, our time and our talents. And how do we manage those things for those who have lived by faith as believers? And we wanted to make sure that we ministered to that particular demographic.

Dave is obviously serving everybody whether you’re a person of faith for not. But he wanted to make sure that we had a branch of our organization that just ministered to those people of faith, and broke down what the Bible says about money. There are 2,350 verses in the Bible all about how to handle wealth and possessions. We want listeners to not only be educated, but empowered, and that they feel a little bit of encouragement and hope wherever they find themselves in their stewardship financial journey – when they apply themselves they can find themselves being successful on the other side.

It’s a twenty-five minute show, and just like Dave’s it’s a call-in show. Dave Ramsey has a call-in show Monday thru Friday. It’s a three-hour call in show in 550 plus markets around the country. Mine is a twenty-five minute show. It’s also call-in. I occasionally have a guest, or I occasionally do a full teaching myself, but it’s on Monday thru Friday, as well in 20 different markets and both of us have podcasts that are associated with the show, and also we stream on our websites.

AD: With so many financial gurus out there with their own systems for wealth building, do you find that some people perceive Financial Peace University to be a hustle or is it perceived the way you guys intend it to be?

CB: I’ve never really thought about it that way because we’re really focused in on what we’re trying to do. We like to say that we’re on a crusade. We’re really trying to enhance a movement that’s already started so we’re more focused in on what we’re doing. I don’t know about what all of the other gurus are doing. I don’t know if there are any, if they’re twisted or if they’re shady. I’m actually not familiar with any of that, but I do know that we have a very loyal tribe, and I also know that there are a lot of results, and people will follow where there are a lot of results.

Over the last twenty years there have been over four million people who have gone through this class and have experienced an average $8,000 swing in their finances in just the first 90 days. And so for around $100 for you to enroll in Financial Peace University and have a kit and some resources, and a book and all of that kind of stuff – after 90 days to have an $8,000 swing in your finances, for me the value of that is so big. There’s never been a question about the value added to society. So I really feel that way. We give away a bunch of stuff for free on our websites and podcasts and radio shows. It’s our way to serve the community.

AD: From your testimony at the tour stop, it sounds as you were pretty deep into the real estate investing world and experienced a lot of success, which is a lot of further than I ever got. I did some learning, but never got any deals done. Based upon your experience, once someone’s life becomes “Financially Peaceful”, would you recommend that arena for someone else? Once you get out to Baby Steps Five and Six and you’ve got money in the bank and no debt; you’ve got your 15% retirement savings going, and you’re saving for your kid’s college funds, would you recommend someone going into the real estate investing arena to acquire properties, flipping homes, and similar things?

AD: From your testimony at the tour stop, it sounds as you were pretty deep into the real estate investing world and experienced a lot of success, which is a lot of further than I ever got. I did some learning, but never got any deals done. Based upon your experience, once someone’s life becomes “Financially Peaceful”, would you recommend that arena for someone else? Once you get out to Baby Steps Five and Six and you’ve got money in the bank and no debt; you’ve got your 15% retirement savings going, and you’re saving for your kid’s college funds, would you recommend someone going into the real estate investing arena to acquire properties, flipping homes, and similar things?

CB: Let me just say that investing in real estate is great. So there are a couple of factors. First you have to make sure that you’re already diversified. What we teach in Baby Step Four, which starts getting into investing, is to start with 15% of your household income going towards long-term investments – things with tax advantages.

You want to think long-term so you want to make sure you’re diversified: mutual funds, 401-Ks, Roth IRAs, 403-Bs, 457s, those kinds of things first. Then you’re going to go to Baby Steps Five and Six; pay off your primary mortgage first – that primary has to be paid off first, and then you can get into rental homes, flipping homes, but only with cash so you’re not borrowing anything for that to happen.

So let’s say you go out and buy a $100,000 house with cash and two and a half years later you sell it for $175,000 – that’s really good. You get cash, you use that $175,000 and then you go buy two properties for $70,000 each, and then clean them all up, and then two years later you sell them both for $200,000 each, or $150,000, whatever it is, but it’s always with cash. You also want to buy investment properties where you have a local intelligence where you are, and where you can feel it. You don’t ever want be a landlord if you’re living out of town. You want to do it in your town.

AD: As a literacy Examiner, from time to time I’ve written about money, not telling people what to do or trying to sound judgmental myself, because I’m not rich and have made my share of money mistakes. However, I think the principles of Financial Peace University and money lessons in general are important to talk about. With the exception of one or two pieces I’ve written, many of my financial articles have gotten little to moderate reaction. Have you found money to be a sensitive topic in your experience, and if so, why do you think that is?

CB: I’ve personally seen more traction on articles, and videos and teachings when they have a personal, emotional or a relational component in them. So it’s not really just about the facts because we live in Google society where you can look up the information. You need the inspiration with the information – some kind of personal or vulnerable moment whenever you’re explaining anything financially or some kind of personal anecdote. Those pieces tend to be shared and liked a little more often because, yes you’re right, it’s a sensitive topic.

It’s taboo to talk about money and there are lots of opinions out there and nobody can argue with your experience. For me, I deal with the faith-based side and on the faith-based side you can’t argue with the scriptures. So I lead out with the scriptures and my experience and that’s a lot better than if I do a cold article that says, “Here are the three steps to budgeting”. You can find that stuff on a lot of different websites, but what you can’t find is your story.

AD: You’re right, I wrote a piece called, The Difference Between Being Cheap and Frugal, and it got a lot reaction I think first because I told a story with it in a humorous way, and also because it’s something a lot of people have been personally faced with.

When you were coming up, did your folks talk to you about a lot of this stuff or did you have to find it all out on your own?

CB: I have an interesting story. This is pretty cool. I did not have a dad growing up. I actually had four fathers who were all violent and we were always running away from them, from abuse shelter to abuse shelter. So I didn’t have a dad and my Mom, because she was a single, Mom was always working three jobs and was never home. So I really raised myself, but I say that liberally because I’d be sitting in an apartment with no food and no furniture for days at a time completely bored stiff, but the one thing I did have was my Yellow Sony Walkman; if you remember from all the way back in the day before the Sony Discman.

CB: I have an interesting story. This is pretty cool. I did not have a dad growing up. I actually had four fathers who were all violent and we were always running away from them, from abuse shelter to abuse shelter. So I didn’t have a dad and my Mom, because she was a single, Mom was always working three jobs and was never home. So I really raised myself, but I say that liberally because I’d be sitting in an apartment with no food and no furniture for days at a time completely bored stiff, but the one thing I did have was my Yellow Sony Walkman; if you remember from all the way back in the day before the Sony Discman.

I was listening to the radio and I was never a really big music guy at the ages of 11, 12 and 13 years old. I was always more intrigued by learning because to that point, I had just been sitting around the house by myself and bored, and we didn’t really have TV and cable or anything like that, so I was just intrigued by things that would get me to think. So I would listen to guys like: Charles Stanley, James Dobson and Larry Burkett, and then later on Dave Ramsey.

Pretty much the radio raised me. I mixed that in with some pastors, some teachers and coaches – there ended up being some bosses later on that really walked me through life and taught me these principles. Then I found out about Financial Peace University which made it more formalized. But for me, I was never taught this stuff other than listening to the radio, and no one ever sat me down in a formal setting and taught me these things. For me it just clicked and as soon as I knew that it was God’s way of handling money, it made sense to me.

I actually didn’t make a lot of money mistakes in middle school, high school or college. I did great financially starting off as an adult. I was the man. I was rocking and thinking that what I was doing at the time really worked. And then one day I decided I was going to get cocky. I was flipping homes and I said, ‘Why am I flipping homes one at a time? This is great. This is fun. This is awesome. I’ll flip eight at a time. I’ll go borrow a million dollars and I’m going to expedite this thing. I’m going to get rich quick.’

The year was 2007 (the start of the bursting of the housing bubble) and for the next 36 months I couldn’t put a renter in any of my properties and I couldn’t sell any of them, so I was paying out $10,000 a month on vacant homes all of the way to January 2011 when I had to walk into a filled courtroom, look a Trustee in the eye and I had to file bankruptcy. So it was a major fall because of one month of getting greedy and getting cocky. So I was never taught, but I learned more from that big mistake than I learned all of the rest of the time. I will never go borrow again, not even for a house. I will never borrow money again period.

AD: So at the DC Smart Money Tour stop you told us the funny story about your sons and the garage door. As an education writer and a science tutor, I’m always fascinated by what resources some kids have access to early in their lives versus others, because what you learn at a young age can greatly impact your life as an adult. Are these lessons you’re going to teach them gradually? Or are you going to sit them down one day and say, “Okay guys, we’re going to sit down and watch Financial Peace University today and then we’re going to debrief afterwards”? How are you planning to do that?

CB: The best thing I can do is teach them the world view and the heart behind good financial management. I don’t want to manage their behavior, I want to manage their heart and so every day from the time they’ve been able to retain a thought – so four, five, and maybe six years old – anytime anything happens with relationships or anything else, there’s a great teaching opportunity to say, ‘That relationship, that brother of yours, God has put that relationship in your life trusting you to make sure you handle that relationship well and for His glory.’ And they’re not going to get it right away, but I’m planting seeds all of the way throughout their childhood.

Now as far as formal guidance, they’re already getting that. They actually love it because kids are sponges. We have what we call Financial Peace Junior. It’s a great curriculum and age appropriate for my kids and they actually love it. They’ve got this savings jar and it’s got three different compartments where you: give, save, and spend.

They have a chore chart where they get commissions for their chores. Two of my three have bank accounts where they save and we go out to the mall and they save their saving part, give their giving part, and spend their spending part. So it’s been great and when its time they’ll go to the next curriculum for middle-schoolers and high schoolers; Generation Change and then Financial Peace University. I don’t ever want to make them do anything. I want them to want to, and I’m never going to force them.

I think the only thing I would do if they were rebellious and looking to get married at 23 years old, I think about six months before they got married, if they hadn’t done it yet, I would probably bribe them to make sure they’ve got it in their brain first. I’d say, ‘I’ll give you $200 to watch this class just so that I know that you did,’ and just so that I know that I equipped them on my side as a parent. I would say, ‘You’ve got to listen to this. This is going to save you thousands and thousands of dollars, maybe even millions if you sit down and watch this.’ So I would make sure that before they got married they did it, but I don’t think I’m going to have that problem so far.

AD: And once again Chris, when does your show come on? You have a livestream broadcast right?

CB: In DC we’re on at 3:30 pm on 780 AM-WAVA. And, of course, we’re on in 20 different markets at all different times from noon to 8 pm depending on the market all of the way from Seattle, Portland, San Diego, Washington DC, Detroit, all over the place. We also have iTunes podcasts and we’re on Google Play and we’re also at Stewardship.com. So there are lots of different places people can connect with us.

AD: Well Chris, those are all of the questions that I have.

CB: Thank you, Anwar, we appreciate all of your work.

A special thanks for this interview goes out to: Chris Brown, Dave Ramsey Solutions, to the Alfred Street Baptist Church, and finally to Tommy and Erica Walker, founders of the Financial Peace University Ministry at the Alfred Street Baptist Church.

Thank you for taking the time out to read this post. If you enjoyed this post, you might also enjoy:

• The difference between being cheap and frugal

• We should’ve bought Facebook and Bitcoin stock: An investing story

• Your net worth, your gross salary and what they mean

• Simone Griffin discusses homeownership and the African American community part one (also parts two and three)

• Mother’s Day 2017: one of my mother’s greatest gifts, getting engaged and avoiding my own personal fiscal cliff

• Father’s Day 2017: reflections on some of Dad’s money and life lessons

If you’ve found value here and think it would benefit others, please share it and or leave a comment. To receive all of the most up to date content from the Big Words Blog Site, subscribe using the subscription box in the right hand column in this post and throughout the site. Please visit my YouTube channel entitled, Big Discussions76. Lastly follow me on Twitter at @BWArePowerful, on Instagram at @anwaryusef76 and at the Big Words Blog Site Facebook page. While my main areas of focus are Education, STEM and Financial Literacy, there are other blog/sites I endorse which can be found on that particular page of my site.

One of the goals for my blog is to help expose for other individuals with new and novel ideas/projects of their own which is in line with my principle of “

One of the goals for my blog is to help expose for other individuals with new and novel ideas/projects of their own which is in line with my principle of “ I rededicated my life to Christ at the New Year’s Eve service going into the 2010 year. I prayed for help, and I started studying scriptures about health and wellness. I read

I rededicated my life to Christ at the New Year’s Eve service going into the 2010 year. I prayed for help, and I started studying scriptures about health and wellness. I read  JT: That’s a great question. Healthcare starts in your kitchen and obesity costs our country a lot of money annually – roughly

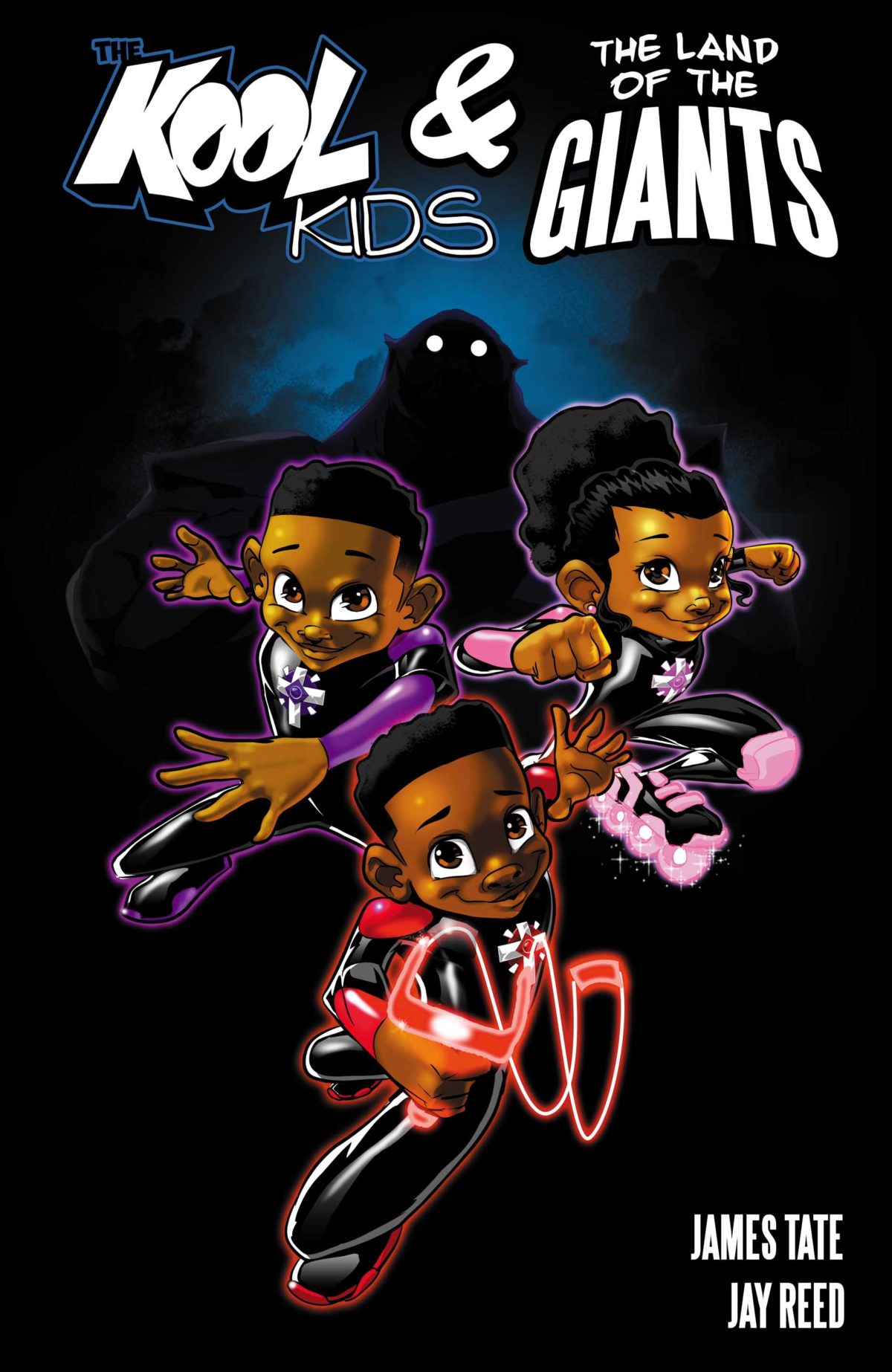

JT: That’s a great question. Healthcare starts in your kitchen and obesity costs our country a lot of money annually – roughly  JT: The Kool Kids are a group of Christian kids who will motivate, educate, and inspire you and your family to defeat the giants in your life/land – giants such as

JT: The Kool Kids are a group of Christian kids who will motivate, educate, and inspire you and your family to defeat the giants in your life/land – giants such as  Around 2012, two friends introduced me to Dave Ramsey’s

Around 2012, two friends introduced me to Dave Ramsey’s  AD: From your testimony at the tour stop, it sounds as you were pretty deep into the real estate investing world and experienced a lot of success, which is a lot of further than I ever got. I did some learning, but never got any deals done. Based upon your experience, once someone’s life becomes “Financially Peaceful”, would you recommend that arena for someone else? Once you get out to

AD: From your testimony at the tour stop, it sounds as you were pretty deep into the real estate investing world and experienced a lot of success, which is a lot of further than I ever got. I did some learning, but never got any deals done. Based upon your experience, once someone’s life becomes “Financially Peaceful”, would you recommend that arena for someone else? Once you get out to  CB: I have an interesting story. This is pretty cool. I did not have a dad growing up. I actually had four fathers who were all violent and we were always running away from them, from abuse shelter to abuse shelter. So I didn’t have a dad and my Mom, because she was a single, Mom was always working three jobs and was never home. So I really raised myself, but I say that liberally because I’d be sitting in an apartment with no food and no furniture for days at a time completely bored stiff, but the one thing I did have was my Yellow Sony Walkman; if you remember from all the way back in the day before the

CB: I have an interesting story. This is pretty cool. I did not have a dad growing up. I actually had four fathers who were all violent and we were always running away from them, from abuse shelter to abuse shelter. So I didn’t have a dad and my Mom, because she was a single, Mom was always working three jobs and was never home. So I really raised myself, but I say that liberally because I’d be sitting in an apartment with no food and no furniture for days at a time completely bored stiff, but the one thing I did have was my Yellow Sony Walkman; if you remember from all the way back in the day before the