My blog focuses on Financial Literacy/Money and Business/Entrepreneurship. Real estate investing can be very lucrative if you know what you’re doing? There are likewise valuable investment tips to keep in mind. The following contributed post is entitled, Property Investment Tips for People New to the Market.

* * *

If you want to invest in the property market but aren’t sure where to start, then you have come to the right place. This guide will show you what steps you can take to understand the basics of the market, so you can not only decide to invest but also make sure that you have a solid foundation to work from moving forward. If you want to find out more, then all you have to do is take a look below.

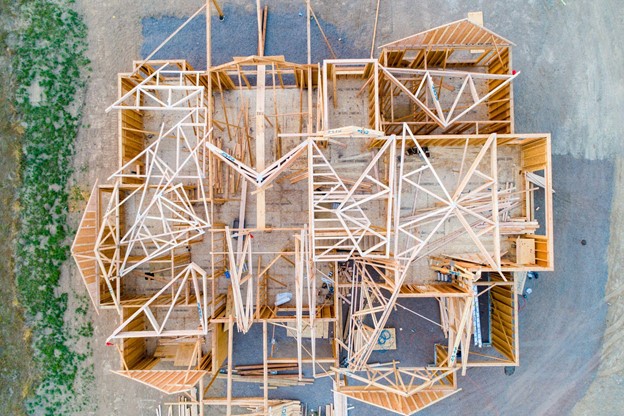

Source: Pexels

Know the Risks

One of the first things you need to do is understand the risks. It’s very easy for you to get carried away when buying a property, and you may also find that it’s easy to invest in the wrong thing as well. If you want to help yourself here, then you need to mitigate as many risks as possible by carefully planning out every aspect of your investment. You also need to carefully plan out your investment so you can make sure you have a solid strategy as you move forward. You need to seek out the best opportunity for long-term success, and you also need to focus on things that have the lowest risk if you can. Research locations that have the highest possible growth and monitor the impact of the real estate market so you can be aware of things that might impact your investment.

When you do this right, you can then take advantage of the property market being rewarding. You can also ensure a strong financial position, which is everything. One thing to take note of is that risks can be specific to the investor, and a lot of the time, they are based on their financial circumstances. Some risks that you will face include tying your money up and dealing with rising property prices. Property prices can fluctuate over time, and a lot of it comes down to the demand for rental properties. You can overcome this by remaining patient and taking your time to ride out any losses. If you can do this, then you will find it easier to earn a profit, and you may also find that it is easier for you to mitigate any risks this way, too. Buying cheaply is another way for you to reduce the risk, especially in the short term.

Finding the Right Tenant

While the success of your property investment largely comes down to you as an investor, tenants can also impact your investment quite a lot. Unreliable tenants will delay and they will not pay their rent. Sometimes you may also find that it’s important to carry out checks, so you can carry out finance checks as well. If you want to avoid all of this stress, then you can hire a property management service to take care of it for you. When you do, you will soon find that they can impose fines if your tenant does not pay their rent on time, which is great to say the least.

Develop a Plan

You need to have a plan if you want to invest in property. You need to understand what it is and how you intend to get involved. You also need to secure an investment property and find out if it’s the right thing for you to do. Regardless of the type of investment you need to make, you have to make sure that you comply with all of the right regulations. You also need to keep on top of your finances and make all of the right tax payments. Knowing how your taxes are impacted by your finances will help a lot here, and it will also help you to understand whether you need to make a freehold or leasehold purchase. As for other legal requirements, if you have a buy-to-let property, you need to take the time to understand the tenancy laws that come with renting out your property. Your property management company may be able to help you out here, and they may also be able to help you ensure that you are fully compliant. If you can keep this in mind, then it will help you a lot.

Finding the Right Time to Invest

It’s so important that you monitor the property market and that you find the right time to invest. Choosing a home when the market is doing well is so important if you want to set yourself up for success in the future. Investing in the market is a good investment as property prices look to be very affordable, with them increasing over the next few years. As well as taking the time to monitor the market, you should also take the time to invest on a personal level. You need to make sure you have enough time to invest, and you also need to make sure that you are assessing your finances at all times. You also need to find the right property to invest in as well. You should not rush the process of investing in a property. You should also spend time researching so you can make sure that you are gathering as much information as you can. When the time comes to review different properties to invest in, you should also look at the needs of your tenants. If you are investing in a buy-to-let property, then choosing the right property will help you to fulfil these needs. Be sure to carry out your market research as well, as this is a good way for you to make sure you are getting a good return on your investment overall.

Plan your Strategy

When conducting research, you need to consider what strategy is going to work best for you. The common strategy is buy-to-let, but at the end of the day, there are other options out there too. The main strategies that you need to consider are buy-to-sell as well. This is a good way for you to flip a home. If you want to sell a home quickly, then you have to understand that the market isn’t your only option either. You can look into sell my house fast cash services, as they allow you to not only get the result you want out of your home, but also get a fair price in a very short space of time.

When it comes to things like this, investors will buy a property to sell it, usually for a profit. When the property has been bought, investors will then take the time to refurbish the property and make sure that it is up to scratch. This will then increase the value and allow them to get more money from it. This property strategy is otherwise known as house flipping, as it is a good way for you to not only increase the value of your home but also make sure that you are getting the most money from it. It’s important to look into things like this if you can, as it is a good way for you to improve your financial gain while also making sure that you have a clear path as to how you are going to sell your property and the money you are going to make from it. There isn’t a one-size-fits-all approach here, so take the time to see what works for you and then go from there. That way, you’re easily able to get the result you want, so keep that in mind. You can also get additional property tips online, if you’d like to expand your horizons a bit.