A Quick Plug

Hello. Thank you for clicking on this link and I hope you enjoy this essay. Writing a book was the genesis of me blogging and becoming a video content creator. I am close to publishing part one of my book project entitled, The Engineers: A Western New York Basketball Story. Please consider visiting the page to learn more about the project and see promotional content I’ve created surrounding the project. And now on to our feature presentation.

Motherly Guidance

A couple of years ago when still writing for the Examiner, I wrote a sentimental tribute piece about my mother for Mother’s Day discussing everything she did for my brother and me. In short she put being a mother first above all else. Looking back at my youth I don’t remember her really partying aside from holiday celebrations at her places of employment. There were always lots of home cooked meals, togetherness, and church on Sundays, though I didn’t appreciate it at the time. There was also a lot of love and positive affirmation in our home.

Her motherly guidance continued well into my adulthood. One of her greatest gifts was given to me a couple of years ago, and I can guarantee that it isn’t a gift that you the reader would expect. It was a lifesaving gift – one that impacted our immediate family, and that helped stop me from going over my own personal “Fiscal Cliff” and falling to my demise. I’m sharing this story because I think about it often, but also so that it might help save someone else. This post will probably likewise touch someone, and maybe draw a laugh or two, or three, or four.

Fiscal Cliffs

Many of you remember the term “Fiscal Cliff” from one of President Barrack Obama’s earliest showdowns with Republicans regarding the financial future of the United States – at the time a potential massive increase in taxes and broad spending cuts. There are also be personal fiscal cliffs – situations in which a particular set of financial factors causes or threatens sudden and severe economic decline. While the sizes and scales are different, they both involve needs, wants, how items in question are going to get paid for, and the after effects.

Only those really close to me know that I was engaged to be married two or three years ago. Not being one to post my personal business all over Facebook, I initially told only a trusted few. My former fiancée will remain anonymous, and my challenge likewise will be to tell this story in the fairest way possible, without demonizing and piling on her, as it would show very little class, so wish me luck. Instead, I will focus on something my mother shared with me, and how it stayed with me as my brief engagement unfolded. There were actually a couple of quotes that stuck with me but hers was special.

Ring Sizes and Customs

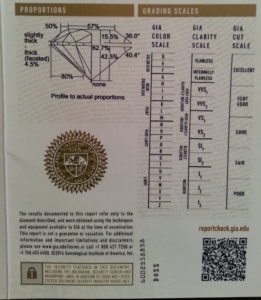

“You know it’s the custom for the bride’s father and/or family to pay for the wedding,” my mother told me shortly after my fiancée accepted my proposal (which I botched by not doing the getting on one knee ritual). I didn’t know the first thing about weddings and in the previous year had to learn quickly about the “Four Cs” for picking out engagement rings: Cut, Clarity, Carat size, and Color. Depending on the woman, rings can be a really, really big deal – perhaps too big a deal in the grand scheme of things. That’s a separate discussion.

Living in two different cities, there were a lot of details my fiancée and I had to work out besides the wedding itself. We loosely mutually agreed that the ceremony should be held out in the city she was from on the Pacific coast. I think it was around that time a ballpark number for how much we would spend on the wedding emerged; $18,000 which quickly got rounded up to $20,000. The funny thing is I think I threw the number out there – not because I had dreamt of spending that amount, but because I had heard two friends say that they had spent that amount on their wedding with some help from their folks I believe.

How to Get Married

After she accepted the proposal, things went fast. Within a week, a close friend sent her a “How to Get Married” book with all of the planning and steps. There were also plans to go dress shopping in New York City just like the show Say Yes to the Dress. There is a lot I could say about what all happened next, but for the sake of keeping this focused, I’ll just say that there was a lot of deliberation over the amount to be spent. While I wanted to keep it at $20,000 or below, my fiancée lobbied to push the number upwards.

“You’re probably going to end up spending a little bit over what you set the budget at,” my mother said, which didn’t make me feel any better.

“How many people are you all inviting? The dollar amount is going to grow exponentially with the number of guests you’re inviting because you’re going to be feeding all of those people,” a close friend and fellow University of Michigan alumnus said, who had gotten married while we were all still in school. He and his wife spent a little over $10,000 of their graduate school stipends – a tremendous feat.

It’s the custom for the bride’s father or family to pay for the wedding, my mother’s words continued to roll around in my head. But whose custom was this? And what if the bride’s father or family didn’t have any money? Then what?

Eventually I started to ponder the enormity of spending $20,000 on our big day. I started thinking that it wasn’t a smart idea even though I was a federal employee with a, “good government job.” I had only recently gotten rid of my revolving consumer debt and didn’t have a substantial emergency fund in the bank, and neither did she. I had also only recently started getting the 5% matching contribution on my government Thrift Savings Plan retirement account. Furthermore, I had my eyes on buying stock, and moving into the wealthy class.

What Can One Do with $20,000?

It’s the custom for the bride’s father or family to pay for the wedding. What can one do with $20,000? One can use it as a down payment on a home (depending on the market). One can purchase a brand new car. One can invest that money and grow it. One can donate to charities and scholarship funds for needy kids. It can also simply be put away for an emergency fund for life’s inevitable calamities. It can be used to start a business of some sort. In this case it could also be spent on a one-day bonanza for friends and family who would go back to their lives afterwards.

“What you all need to do is live off of one of your incomes for a year and save the other one,” one of my mentors said when I told him that I was thinking about making the big plunge months earlier. He was an experienced entrepreneur several years my senior and had seen a lot in his life’s journey. “You all need to save $50,000 in the bank – actually black people need to have $100,000 in the bank,” he continued. “Whenever we’re jobless it takes us longer to get hired.”

We need to save $50,000 in the bank? We need to save $100,000 in the bank? In addition to my mother’s words about the bride’s family paying for the wedding, my mentor’s words also bounced around in my head. Was such a thing even possible? With proper planning and prioritization, something that experts in estate planning like Dean Godfrey can help with, and agreeing in a relationship context, absolutely it was possible. While I could see the power in doing such a thing however, I wondered how realistic it was for the particular set of circumstances I was in. My fiancée and I didn’t reside on the same planet money-wise, and in several other key ways, which gets to the being ‘equally yoked’ principal that’s often discussed when long-term relationships come up. This living off of one income for the first year advice actually wasn’t new. It was just my first time hearing it.

Michelle Singletary’s Revelation

I found out something else highly relevant to this discussion by chance in the Washington Post. It was shared by Michelle Singletary to whom I have to give the credit for citing it in her “Color of Money” column. In an article discussing finance-related topics couples should discuss before getting serious (credit scores/history for example), she cited a study by Emory Professors Andrew Francis and Hugo Mialon titled A Diamond is Forever’ and Other Fairy Tales: The Relationship between Wedding Expenses and Marriage Duration. They found that couples who spent greater than $20,000 on a wedding and associated costs are 3.5 times more likely to get divorced than couples who spent $5,000 and $10,000. CNN and PBS covered this as well.

“You know Anwar, $20,000 is actually the low end for the amount spent on a wedding,” another close friend and Michigan alumnus said in the aftermath of the whole thing. That may have been true, but the question in my mind once again centered around whose role it was to pay for all of it. Was it the couple or the bride’s family? Both families? And what were the long-term consequences? Furthermore, was it sane for a couple with no inheritances, and collectively no assets, to invest that type of money in something like that?

My gut told me no, but there is something sentimental, warm and fuzzy when it comes to women, engagements, weddings and shows like Say Yes to the Dress – something that defies all logic and reason. As a man, you can easily get swept up in it all because well – it’s what many women like and what many women want to do. Many have dreamt about their ‘Big Day’ since they were little.

Retrieving Investments?

As alluded to earlier, it wasn’t exactly a stable partnership and life’s many circumstances caused the whole thing to implode. It was actually biblical in magnitude – something made for TV. I thus didn’t have to proceed down the path that was unfolding in front of me which I saw leading me over the edge of my own personal fiscal cliff onto the rocks below. No, I never got the ring back. I got that question a lot – mostly from females I shared the story with, and from one guy – a cunning salesman who was trying to get me to purchase one of his insurance products in a coffee shop one morning. I gladly told everyone no, as it paled in comparison to the money that I would’ve spent had the whole thing gone forward.

A Pakistani Wedding

About a year after my engagement imploded, a close friend got married – a Pakistani woman. I was blessed to be invited to one of the three days of their weekend long wedding celebration/ceremony. That’s right, it was three days in accordance with Pakistani culture – they do it big. The ceremony I attended was at a beautiful hall and had all the trimmings. My coworker and her husband, who was also Pakistani, were both dressed in the most immaculate costumes in accordance with their culture. He actually rode in on a pony. I looked around in amazement as all of us guests were treated like royalty.

She shared with me that her parents and the groom’s parents paid in the ballpark of $30,000 for the whole thing – that’s right $30,000. Coming from the eastside of Buffalo, that’s a lot of money, and afterwards I pondered over and over again that their parents paid for it. It was their culture and the norm in their community. They also had an abundance of stable families where their parents actually had the funds to put into that type of thing – perhaps a demonstration of Pakistani privilege.

I continued to ponder their wedding weekend. Because their parents footed the bill, they as a young couple didn’t take a huge financial hit. They were able to just continue on with their lives and build – saving into their retirement accounts, planning vacations, pondering purchasing a home, etc. They were able to start in a good place. The same was true for another friend. She and her spouse came from two stable families and themselves didn’t personally make huge investments on their big day. The bride’s diamond ring was not purchased at some extravagant store like on TV, but instead, it was passed down through the generations in the groom’s family – again a benefit of coming from a stable family. Up this point, I’ve mentioned the concept of retirement twice. To get a feel for why this is so important, I recommend reading 6 last-minute retirement planning strategies by Brian Perry.

A Big Waste of Money?

“Weddings are a big waste of money,” said a professor on my thesis committee at the University of Michigan with a look of disgust on his face. He was kind of conservative, and had homes in both Ann Arbor and Jackson Hole, Wyo. He had been around a while and had seen a lot of stuff. I didn’t understand any of it at the time so I thought he might’ve just been being an old curmudgeon. He was probably thinking that there were better things that could be done with the tens of thousands of dollars spent on weddings.

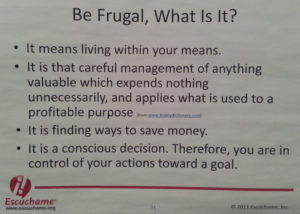

Are weddings, engagement rings, and all of the associated costs a waste of money? As with most things it depends on your point of view. That said, as a couple, before dumping tens of thousands of dollars into something like that, I think it’s important that both agree on it and ask each other several key questions. Are you going into debt for it? Have you already started building wealth individually? Can your relatives afford to kick in? Where will you two be after the festivities once everyone else has gone home? Is spending an astronomical amount of money a need or a want?

“It’s the custom for the bride’s father and or family to pay for the wedding.” I don’t know that my mother knew that her words would stay in my mind as they did. The words made more and more sense to me as I thought about them. From a logical standpoint, if I as a man have just saved for an engagement ring – a month’s salary or more, does it now make sense to dump more money into a one-day extravaganza leaving us financially exposed? For me at the time, no, it didn’t make any sense. By the way, this wasn’t the only advice my mother gave me. As a spiritual woman, there was much more. My father? He didn’t give me much of anything advice-wise. His greatest anxiety/concern was having to fly out to the west coast to attend the ceremony.

Personal Decisions

Everyone has to decide for themselves what’s right as families and cultures are different. As mentioned earlier, after a life of making financial mistakes out of ignorance, and only recently discovering some of the key secrets to wealth building such as knowing what a Net Worth was, my focus was more on savings and investments. Furthermore, having been bailed out of a couple of jams by one of my uncles for example, asking him for more money at that time felt unacceptable. The same was true for my father of whom I also decided it was unacceptable to ask for financial support of any kind at my current station in life.

For any men reading this and thinking about taking the plunge, this stuff is a big deal. Many of the ladies (not all) dream about their wedding and will even critique and mock each other over them, as I witnessed a couple of high income-professional ladies do about a peer who paid for her wedding expenses out of pocket. To cut costs, she and her fiancé wisely did things like cater their reception. He was a master chef and put in some sweat equity of his own on the food. I think they spent ~ $10,000 on the wedding, maybe a little less. Also, some ladies think a spectacular ring is owed them, and will make them feel better during those inevitable rough marital patches. Some will concede the wedding for a $20,000 or ring.

Think about your life, your goals and the long-term ramifications if you’re paying out of pocket. Be real with yourself and your partner. Determine whether or not you’re dealing in needs or wants and where you’ll be on the back end of the wedding. If the two of you can’t agree there then that should, ‘give you pause,’ as my mother would say. Interestingly my father’s second wife felt that past a certain age, there shouldn’t be any expectations for families to help pay for anything, and that’s assuming again that you had parents and families who had the means to begin with.

A $10,000 Gift for Eloping

“My friend’s father told her that he would give her a $10,000 gift if she and her fiancé eloped,” a woman in my former lab said at a recent science conference. Her friend’s father had clearly done the math in his head and projected what a wedding would cost him, and determined that $10,000 would be a fraction of that cost.

Closing Thoughts

While the majority of this story was about me I’m going to close out by going back to my mother as this post is in celebration of Mother’s Day. It was her words that stayed with me throughout this whole experience. That being said, one of the challenges to growing up is having the discernment to reconcile your parent’s experiences/beliefs and words of wisdom with your own situation as the two don’t always go together. Sometimes you do inevitably deviate from what they recommend for any number of reasons – sometimes disappointing them and even going through the hardship they tried to protect you from, and sometimes not.

The Big Words LLC Newsletter

For the next phase of my writing journey, I’m starting a monthly newsletter for my writing and video content creation company, the Big Words LLC. In it, I plan to share inspirational words, pieces from this blog and my first blog, and select videos from my four YouTube channels. Finally, I will share updates for my book project The Engineers: A Western New York Basketball Story. Your personal information and privacy will be protected. Click this link and register using the sign-up button at the bottom of the announcement. If there is some issue signing up using the link provided, you can also email me at bwllcnl@gmail.com . Best Regards.