A Quick Plug

Hello. Thank you for clicking on this link and I hope you enjoy this essay. Writing a book was the genesis of me blogging and becoming a video content creator. I am close to publishing part one of my book project entitled, The Engineers: A Western New York Basketball Story. Please consider visiting the page to learn more about the project and see promotional content I’ve created surrounding the project. And now on to our feature presentation.

A Disclaimer

Before I start this story, I want to issue a warning to the ‘low attention span’ people. This post is roughly 2000 words. Thus, if you can’t focus for that long, feel free to leave now go and read something else. I can assure you though that this is a fun and educational story with some very important points at the end. With that, I’m going to jump in.

Another Dad Story

Well it’s that time of year again, Father’s Day. As such, just as I have prepared a 2020 post for Mother’s Day, I have also prepared a 2020 post for Father’s Day. Like my first ever Father’s Day post on my blogging platform, this story involves a subject that’s near and dear to my heart, money and wealth building. As with all my Dad stories, this one made a lasting impression on me as I hope that this does for any readers.

In his prime and slightly beyond, my Dad was a force to be reckoned with, one which struck fear into me, even in my early 30s. I lived with him in New York State’s Capital Region during my postdoctoral fellowship which turned out to be an educational experience on several different levels. It was a surreal two and a half years in hindsight that forever changed me. Some of the changes were due to external factors while some were due to internal factors.

Lessons from Rich Dad

Just before leaving Ann Arbor, MI for the Albany area, I picked up Robert Kiyosaki’s Rich Dad Poor Dad book and discovered the worlds of financial literacy and wealth building, worlds I didn’t know anything about at that time. Most of my life I had my eyes set on being an employee. Reading about being and an investor and all the concepts associated with it was exciting though. According to Kiyosaki, there were people becoming wealthy not by slogging off to work everyday and punching a clock, but instead by acquiring financial asset investments.

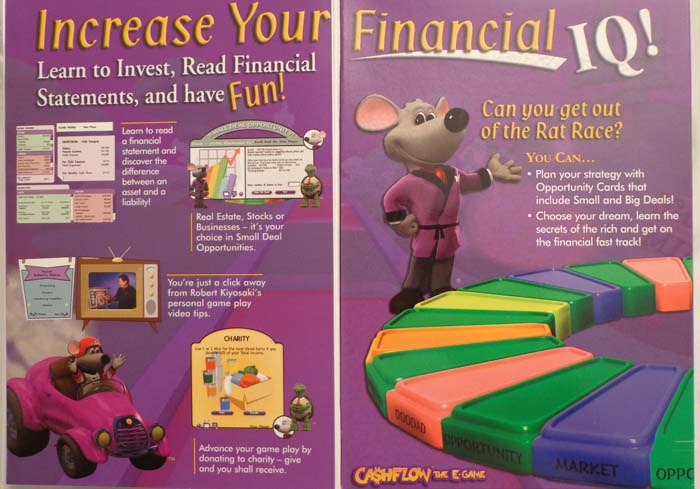

In addition to Kiyosaki’s books, I purchased a copy of his game, Cashflow 101, the electronic version. Unlike the board game version which you have to play with other people, I could sit down at my PC and play every night. The goal of the game is to get out of the Rat Race and onto the Fast Track. For those who have never played the game, you must choose a profession. The chosen profession comes with a salary, and a certain number of assets and liabilities. The cost per child varies with profession as well.

A Lifelike Game

The game is realistic in that high income professionals like doctors, lawyers and airline pilots make more money than the janitors or the web designers. They also have greater expenses and usually more student loans in the case of the doctor and lawyer. They might even have loans under debt review as a result.

Take a look at my 2018 Father’s Day blog post which has a special significance for my brother, my father and me. That post coincidentally involved careers in medicine and law which Dad wanted my brother and me to pursue. Going back to the game, individuals playing the game must figure out how to generate enough passive income from their investments to pay all of their bills monthly and annually. This allows them to become financially free and moves them onto the Fast Track, and live the life of wealthy business owners and investors.

On the road to getting out of the Rat Race, in addition to getting the opportunities to participate in stock and real estate deals, participants sometimes also have children, have to purchase doodads (random expenses or luxuries which drain your money), and face unexpected crises like car accidents, all of which can act as financial setbacks. This forces players to think about their objectives creatively and still figure out ways to get out of the Rat Race. In terms of the game, I’ll stop there. It’s an intoxicating game, and it’s one that I highly recommend. Suffice it to say for now, that as I played and started learning, I started experiencing a paradigm shift and aspired to do the same things in real life, things that I would later find were easier said than done. By the way, Dad saw me regularly playing the game and probably thought I was nuts.

Real Estate Investing and Taking Action

One of the things Robert Kiyosaki discussed in Rich Dad Poor Dad was real estate investing and I became interested in it. Some friends of mine in the area were also interested in it and turned me onto our local real estate investing club which I won’t name. There were monthly meetings where the President encouraged us to get into deals and to, “take action.” There were also big time real estate speakers like the land lording guru Don Beck, whose program involved putting your rental properties on ‘cruise control’ and also creating rental leases that were as protective as possible for the land lords against the problem tenants.

Most of the club members were seniors in terms of age and my two friends and I may have been the only minorities there. Coincidentally an older woman, named Mary, agreed to mentor me. Mary had been in the game for a while and had already started acquiring properties. I think she had her Multiple Listing Service (MLS) certification and had the ability to search its databases. I met another younger guy, whom I’ll call Tyler, who also had the wealth-building mindset and was living it. We talked one Saturday during a field trip we took around our area to look at properties. Tyler turned me on to T. Harv Ecker’s book, Secrets of The Millionaire Mind, which is a short but good read.

Like our President, Mary also encouraged me to do my first deal and we started looking at properties in the Albany area. I recall once going into an empty brownstone and looking around with her near the Albany state capital where my research lab was located. We eventually found a duplex in the downtown area, with a flat roof and one tenant living in it already. Mary suggested that I could live in one unit for a little and rent the other unit out (owner occupied status). Eventually I could move out and ‘cash flow’ the entire property. It all sounded cool and a little scary. I wanted to do it, but how would I do such a thing?

Early Lessons in Real Estate Investing

For those unfamiliar with purchasing real estate, there are usually three critical items lenders want to see: employment history of some sort (especially if you’re new), your credit score and savings of some kind (over a series of months, not random gifts). Depending how savvy you are, you may be able to structure your deal so that you don’t have to pay the closing costs up front. I just barely qualified in terms of my credit score. It wasn’t great at the time, but it was just good enough. I’d only finished my Ph.D. one to two years earlier. I paid my bills on time, but I was over-leveraged credit-wise for numerous reasons which I won’t discuss here. Finally, I had $2,000 to $3,000 in the bank, but I knew that I would need more. Where would I get it from though? Enter Dad!

Now before I go on, let me warn you that this part of the story gets a little painful, but exciting at the same time. I could save this detail until the end, but it’s worth pointing out here. One of the things this experience (and others) taught me going forward was that while we are all physically living on this world together, we can all exist in different worlds and have different world views. Science is a world of its own. Salsa dancing is a world of its own. Writing is a world of its own. Real estate investing is a world of its own. Being an employee is a world of its own. Each world has its own unique set of rules and mindsets.

Dad Gets Involved

Dad was an employee and an excellent at budgeting and saving. He was also risk averse money-wise, and he had his own personal real estate experience that turned him against land lording forever. According to Dad, he once had a tenant in his lower unit, an older woman. According to Dad, he went downstairs to collect the rent one day, and the woman slid into a supernatural trance where her eyes rolled back and her ears pointed upwards. From that point on Dad never wanted anything else to do with real estate investing and land lording, no matter what the upside was.

I don’t know whether Mary suggested it, or by default I decided to ask him for a loan, but after much internal deliberation, I did and that’s when things got, how shall I say, exciting. I knew my father and lacked confidence when asking him for the financial help. I was pretty scared actually. He didn’t say no immediately, but instead looked at me with a blank stare and told me he’d think about it. I intuitively knew that instead of simple yes or no, it was going to turn into a long drawn out process, and Dad didn’t disappoint.

Dad Weighs In

Dad did, in fact, think about it. His thinking stretched from days to weeks which for me was like death by a thousand cuts as one of my favorite YouTube content creators often says. He asked me questions about my investment idea often from the other room when I least expected them. In some instances, we were in the same room and he’d ask me questions about it with his back to me with no eye contact. Yes, I know it’s odd, but it was just how he communicated with me at the time. At some point I told him to just forget about it, but it continued.

“How much money do you have in the bank?” I don’t remember when in this ordeal that he asked me this question, but I just remember that he asked it. The question suddenly made me feel defensive, naked, picked over and violated. “The bank will want to know how much money you have!” Dad was right about this as I found out in the future when applying for mortgages and refinancing on my own. I actually uttered these same words in a money-related dispute with an ex-girlfriend; that didn’t go over well, by the way, so be careful in those instances.

“I have $2,000 to $3,000 in my savings and my Self-Directed Roth IRA,” I pensively replied.

$2,000 to $3,000 is NOT Money!

“That’s NOT money!” Dad quickly and sharply declared with the precision of an assassin. His words were cutting, and I felt insulted and angry afterwards. I didn’t understand why this whole thing had to drag out like this, and I didn’t understand why we couldn’t just sit down and have a simple step by step discussion about why it wasn’t a good or bad idea. The thing I learned later though was that Dad was right.

What Dad meant by saying that, “$2,000 to $3,000 is NOT money,” was that it wasn’t enough money to safely do what I was thinking about. As in all cases, money is relative. There are people who don’t have $400 saved up and there are people who don’t have $1,000 saved up, so to those people, $2,000 to $3,000 is a lot of money. Speaking of $1,000, losing $1,000 can hurt if you’re not prepared to lose it, which I did when trying to do a real estate deal one to two years after moving to the Washington, DC area.

Some Real Estate Investing Tips

I want to tie up this blog post with my major learning points from this story. They are as follows:

• It’s best to invest safely: Whether you’re investing in real estate, stocks or something else, it’s important to do so from a place of safety. At the time of writing this, to me that means allocating funds strictly for that purpose separately from your essential expenses. This way, if the investment falls through, you’ll still have a place to live, food to eat, clothes on your back, etc. Investing is different from outright gambling, but think about how much more fun a trip to a place like Las Vegas is when you have enough money with which to gamble. Don’t invest your emergency money, the rent or the mortgage. This leads to my next point which involves friends and relatives.

• Be careful about involving the finances of friends and relatives in your business/investing ideas: From 30 plus years of being his son, I knew that Dad was risk-averse and didn’t play around with his money, but his not loaning me the money turned out to be the best thing for both of us because it would’ve poisoned our relationship, potentially beyond healing. I wouldn’t have felt comfortable around him, and it would’ve always been on his mind whenever he thought about me. If you have a money idea, I think the best things is to figure out how to launch it on your own, or until its far enough along for others to see the upside (and benefit for them). This way, if you take the loss, you take it on your own. If you are going to partner with friends or relatives, make sure you share the common vision and that they understand the risks. Finally, I’ve learned that when you’re launching an idea, whether it’s stocks or some other opportunity, savvy investors/partners are more likely to participate in your idea if they can see that you’ve already thought out and invested a significant amount of your own resources into it, unless of course you have an extensive track record of doing what you’re proposing.

• Real estate is a fun and potentially rewarding area, but a complex and dangerous one too: Robert Kiyosaki’s Cashflow 101 is a fun and educational game which to this day I highly recommend. It’s just that thought, a game played with fake money. The game is designed to expand and transform your mindset. Getting out in the field and taking action which most real estate teachers teach, is a different matter. Getting an investment property was a good idea, and Dad admitted that, if I recall correctly. However, not only did I not have enough of my own money in the bank yet, it also wasn’t clear if I was staying in the area.

Levels of Experience

Now let me be clear. Am I saying not to own property out of state? Absolutely not. There are investors who own property in other states or cities, and in some instances other countries. Most of them are experienced though. They have the systems in place to be able to do so, and in some instances, they’re partnering with other experienced and like-minded people.

Think about the martial arts. Dad was a Judo guy so let’s use Judo. The masters in martial arts dojos typically wear the brown and black belts, and one must practice and train hard to reach those levels after starting at the color white. Some trials and errors are involved in ascending to the brown or black belt levels which includes blood, sweat, tears, and being thrown to the mat innumerable times in this case. I would equate this to my lost $1,000 described above which I’ll revisit later on. In short, at the time of my asking Dad for that help, I was the equivalent of a white belt in the real estate dojo.

• Be careful who you share your dreams and aspirations with: Finally, I’ll just say that not everyone is going to understand your dreams and visions, so you can’t share them with everyone. This includes friends and relatives, and this is what Robert Kiyosaki meant towards the end of Rich Dad Poor Dad about finding new friends. Let me be clear in that this doesn’t mean discarding your old friends. It just means that if people don’t understand the world you’re operating in, have had a negative experience in it, or are just not like-minded in general, they may kill your dream. This goes for significant others and love interests as well. So, for your own sanity, be mindful.

Conclusions

So that’s all I have to say on this matter, and I hope that this was educational for someone. It was a bitter situation to go through at the time, but I can look back and laugh at it now. I can also admit that Dad’s response towards me helped me see things from a new perspective in terms of the world around me regarding personal finances, dating and mating, and finally, when being approached by friends and/or relatives to help them start their own ideas like coffee businesses, for example.

The Big Words LLC Newsletter

For the next phase of my writing journey, I’m starting a monthly newsletter for my writing and video content creation company, the Big Words LLC. In it, I plan to share inspirational words, pieces from this blog and my first blog, and select videos from my four YouTube channels. Finally, I will share updates for my book project The Engineers: A Western New York Basketball Story. Your personal information and privacy will be protected. Click this link and register using the sign-up button at the bottom of the announcement. If there is some issue signing up using the link provided, you can also email me at bwllcnl@gmail.com . Best Regards.