Two focuses of my blog are Financial Literacy/Money and Technology. The concept and use of money has continued to evolve within civilization. A significant invention is the creation of the ATM. The following contributed post is entitled, How ATM Technology Has Changed Overtime.

* * *

ATM banking tech has made customers’ lives much easier as the technology allows for seamless transactions anytime, anywhere. Varying bill denominations and cardless automated teller machine access represent two significant breakthroughs that are set to enhance consumers’ banking experience. While financial technology has a long history stretching back to the 1960s, here are four unique features revolutionizing ATMs today.

1. Paperless receipts

If you are a customer who regularly visits banking halls, perhaps the sight of receipt-littered ATM cash points is something you are used to. The majority of customers print their receipts only to glance through their balance and dump the paper into the trash can or drop it on the floor. To some people, printing ATM paper receipts is a fun activity that spices up their banking experience. To address litter and keep their banking premises clean, financial institutions resort to paperless receipts via email.

2. Varying bill denominations

In the USA, ATMs were used to dispense cash only in single denominations such as the $20 bill, making it challenging when change was needed. Realizing that customers want more flexibility in ATM banking, banks have introduced more innovative ATMs that can now dispense multiple denominations of currencies. This has simplified cash withdrawal processes for consumers. Today, institutions like Chase and PNC are rolling ATMs that can issue smaller denominations, including $1 and $5. Being able to withdraw your money in smaller currencies means you won’t end up withdrawing less or more than what you actually need.

3. Cardless ATM access

The smartphone age has prompted innovators to consider building cardless ATM systems. People will be able to use their smartphones to access their ATM funds without any need for cards. Several smartphone manufacturers are starting to build mobile devices with near-field communication (NFC) features. These will make it possible for smartphones to communicate with ATMs in proximity. SunTrust bank intends to implement this feature in their ATM so that customers can use their NFC-enabled phones to transact with their ATMs without cards. This means that smartphones could essentially eliminate debit cards at ATMs in the next few years. Automated teller machines have remained relevant for the past half-century, and the technology behind them continues to evolve for the better through invention and reinvention.

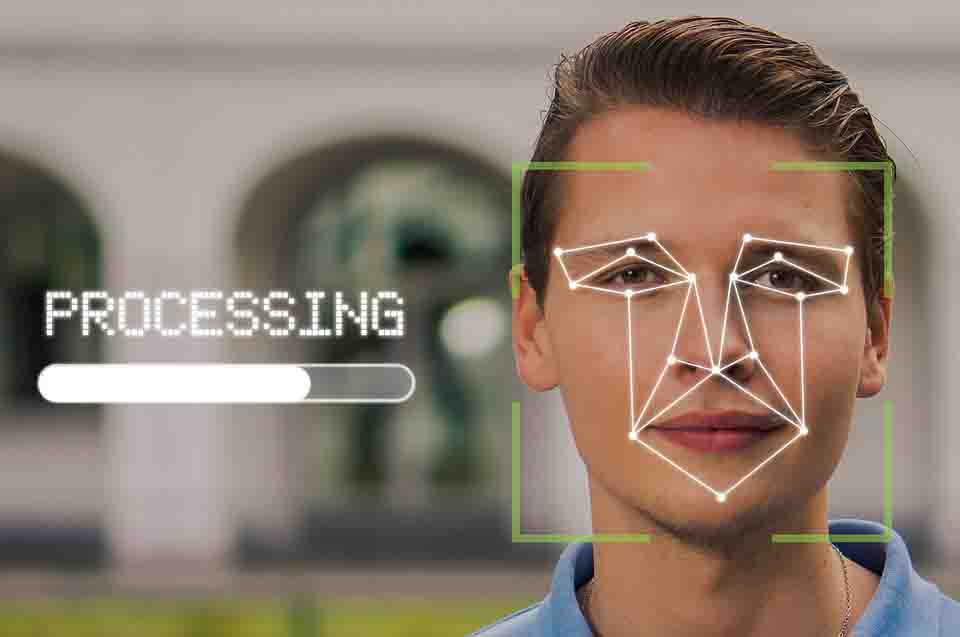

4. Contactless payment and biometric ATMs

Self-service digital banking and automated banking tech are getting smarter by the day, with some ATMs now offering “tap and go” contactless payment options. ATMs with biometric recognition features can identify customer’s fingerprints, irises, and voices. The vital role of ATMs in the financial system owes its success to the effective collaboration between bankers and engineers.

It took more than two decades for ATMs to gain worldwide acceptance, and as of today, there are over 3.5 million of them around the world. Besides, many innovative companies specialize in ATM repair and installation across Northern California and the USA for customer use. If you can keep your ATMs running efficiently 24/7, you are more likely to boost your customer satisfaction.